Initial polls on how Greeks intend to vote in the referendum on bailout terms calmed investors’ frazzled nerves from yesterday, but not before the turmoil wiped out some $1.5 trillion on world capital markets according to Bloomberg. Greek Prime Minister Alexis Tsipras did little to help matters, adding more fuel to the fire by stating that Europe couldn’t allow itself to expel Greece from the EU. Tsipras also confirmed that Greece did not intend to make its 1.55 billion euro loan payment to the IMF before the deadline at midnight tonight.

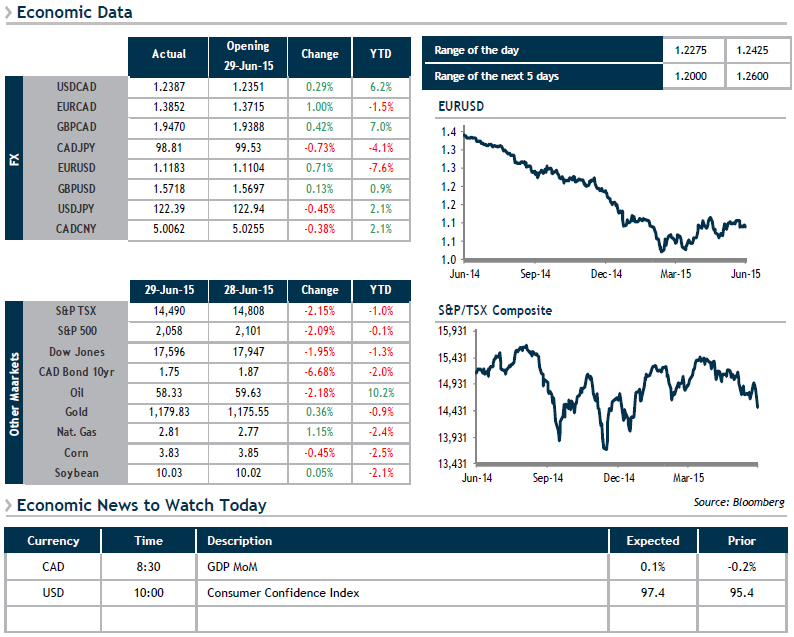

So far, the euro has reacted well to the political turbulence, dipping by only -0.52%overnight. Bond markets have seen a migration of global capital toward German and U.S. issues, which have become a safe haven for investors in these uncertain times.

Meanwhile, in a galaxy far, far away, Asian stock markets are in the green this morning, up 6% in Shanghai. It would certainly appear that the efforts by Chinese authorities yesterday to appease markets have paid off for the moment, but how long will that remain the case?

Today, we’ll learn more about the strength of our domestic economy with the release of Canadian GDP data for April. An annualized growth reading of 1.5% is expected.