Greenback under pressure

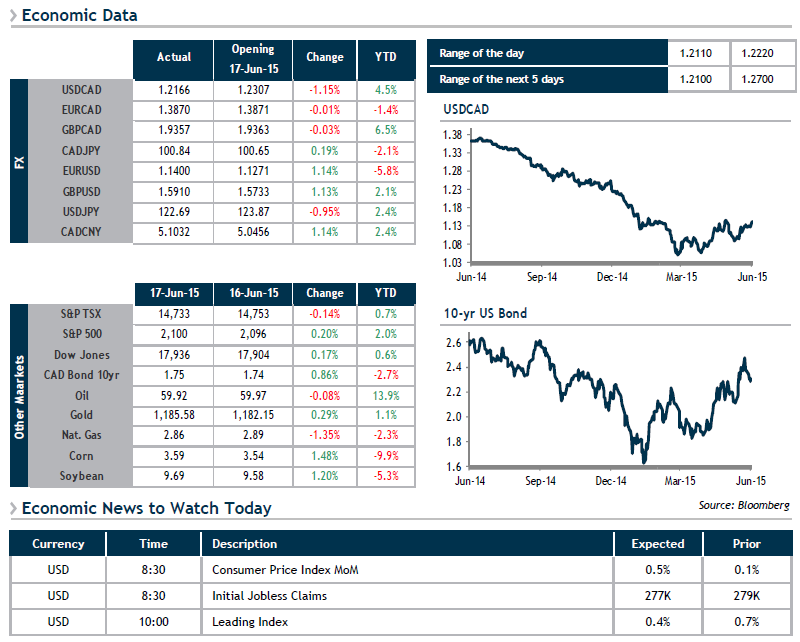

Judging by markets’ reactions, the Fed’s rate announcement yesterday was another disappointment. Fed Chair Janet Yellen refused to commit to a firm schedule for tightening monetary policy, reiterating that the timing would depend on future economic indicators and that the important thing was that rates will go up one day. She also cut her growth forecast for 2015 and 2016 and pointed out that the strength of the USD would continue to weigh on the economy for some time.

For the time being, September’s Fed meeting still remains the favourite for an initial rate hike, which could very well prove to be the only increase in 2015. As a result, the greenback nosedived against all the major currencies, although this does not necessarily mean that volatility is now behind us. Across the Atlantic, the Swiss National Bank expressed concerns that the franc was overvalued, raising the threat that it could intervene. Meanwhile, Norway cut its key rate by 25 bps to support the country’s economy, stating that further cuts could be in the cards. In short, we have an ideal scenario to feed into a currency war.