The Bond Market is Falling

Given the absence of major economic news out of the U.S. and Canada yesterday, markets did nothing on both sides of the 49th parallel, continuing their morose trajectory that began in April, where many days with small positive and negative variations were recorded.

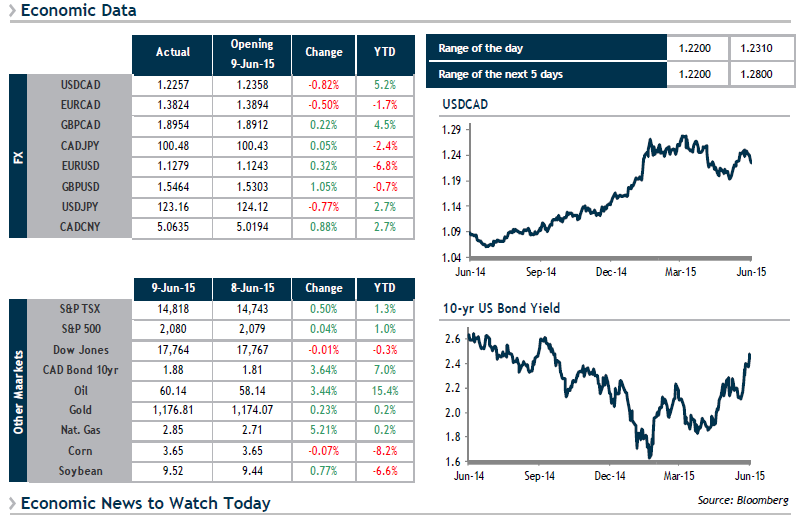

In contrast, the global bond market has continued to record major losses day after day. Yesterday, 10-Year U.S. bond yields passed the 2.40% level, a first since October 2014, which points to a decrease in demand for U.S. debt securities. Canadian bond yields, not at all spared from this trend, rose to reach 1.91%. This is the highest level reached since the surprise rate cut from the Bank of Canada announced last January.

As for currencies, the loonie is continuing on its tear that started last Friday and rose by a few points against the greenback, encouraged by rebounding crude oil prices.

Today we are not expecting many economic indicators in Canada and the U.S., but we will be monitoring bond yields.