Greece makes a proposal

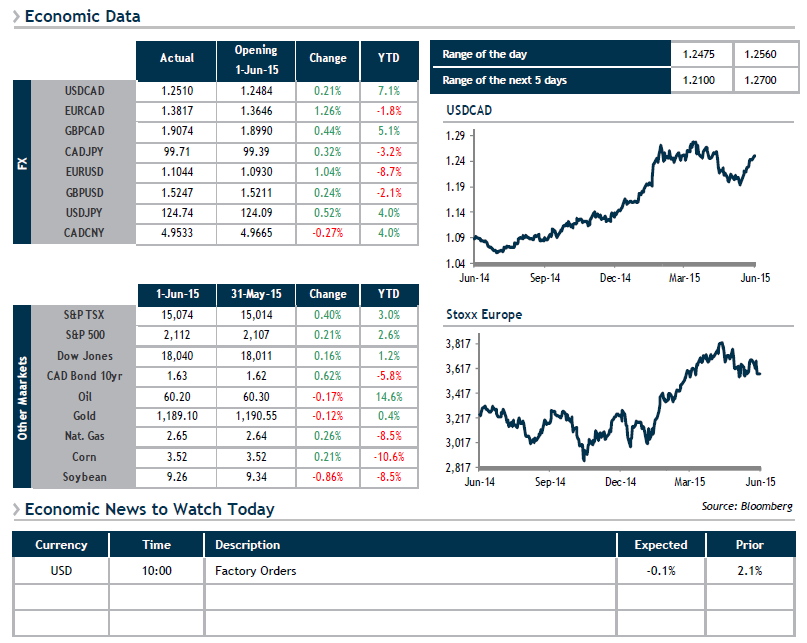

The U.S. dollar had a great day yesterday, outperforming the other most commonly traded currencies. Thanks in large part to the ISM Manufacturing Index, which rose from 51.5 to 52.8 in May, the USD gained 90 points against the loonie and also reached a 12-year high against the yen. North American stock markets also harnessed this momentum and closed out the session in positive territory, although this morning, Wall Street appears to be setting up for an opening in the red.

Late last night, the Reserve Bank of Australia announced that it was keeping its key rate at 2% as anticipated. Meanwhile in Greece, talks are ramping up and Prime Minister Alexis Tsipras has apparently submitted a realistic proposal to the country’s creditors to end the crisis and avoid a default on its debt. It should be noted that Greece owes close to 1.5 billion euros to the IMF in June, of which 300 million must be paid on Friday.