Bank of Canada Key Rate Decision at 10 a.m.

North-American markets had a difficult day yesterday, because positive economic indicators increase the likelihood that the U.S. Federal Reserve will tighten its monetary policy. The next FOMC meeting will be held on June 17, and a growing number of analysts believe that the first key rate hike could take place as soon as September.

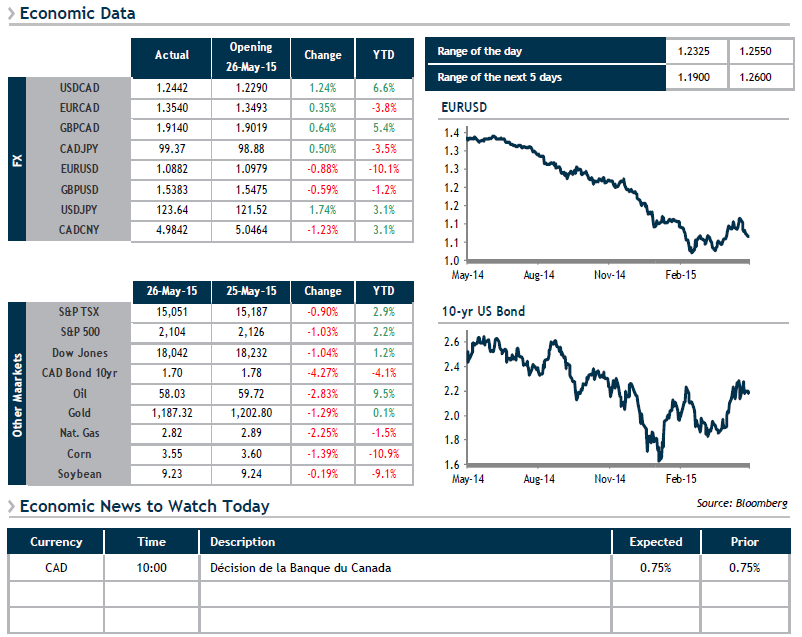

This positive economic data is driving the U.S. dollar, which is trading at its highest level in the past four weeks. While this favours the expansion of margins for Canadian companies, the situation is quite the opposite for U.S. multinationals that generate a substantial portion of their earnings from abroad.

The Bank of Canada’s Key Rate Decision slated for 10 a.m. will ensure a rocky morning for the loonie. It’s hard to forecast what Poloz has in store for us! After cutting the key rate in January, Poloz then surprised the financial community by being rather positive at the April 15 meeting. The comments served to boost the Canadian dollar, which rose by almost 5% in the three weeks that followed.