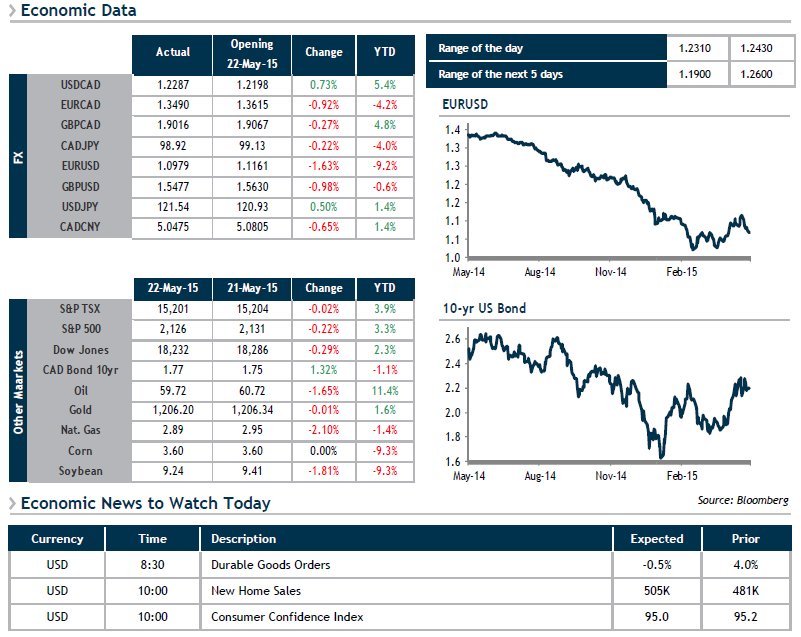

While waiting for the Bank of Canada’s Key Rate Decision tomorrow, many economic indicators of note will be released today in the United States. We will be monitoring Durable Goods Orders at 8:30 a.m., the S&P/Case-Shiller Home Price Indices at 9:00 a.m., and the Consumer Confidence Index at 10:00 a.m. Should results beat analysts’ forecasts, then this would support the U.S. dollar but hinder bond markets.

This morning the greenback is continuing to advance against most major currencies, because the Greek saga is driving investors to seek out safe havens. In addition to boosting the U.S. dollar, this situation is also helping German bonds, which are recording gains. The story is different for the other countries in the eurozone, which are seeing their credit spreads widen. When compared to German bunds, 10-year credit spreads for Greece and Portugal today have widened by 0.59% and 0.11% respectively.

During the night Asian markets recorded gains while the loonie and crude oil prices declined.