In a speech yesterday, Bank of Canada Senior Deputy Governor Carolyn Wilkins tempered the recent optimistic comments by Governor Stephen Poloz, stressing that weak job creation in Canada is a sign that our economy remains fragile.

The U.S. trade deficit for March came in larger than expected at -$51.4 billion rather than -$41.7 billion. Although exports grew by 0.9%, they were overshadowed by the sharp rise in imports, which surged 7.7%. These readings confirm the financial health of American households, who were able to benefit from strong job creation and rising salaries in the past year.

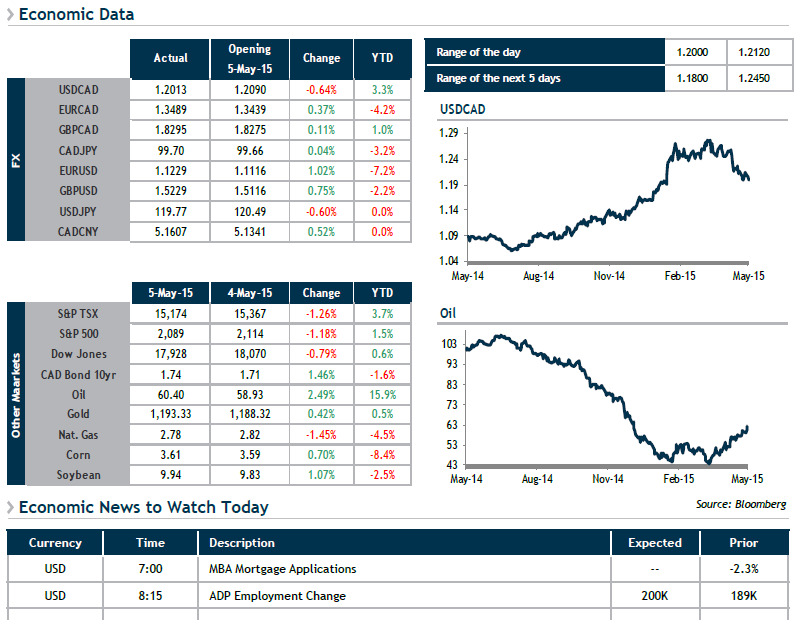

After flirting with $60 a barrel early in the month, crude oil finally broke through that psychological barrier yesterday, and is Up to $62 this morning, which should help the loonie gain altitude today. That being said, market observers, including the highly regarded Goldman Sachs (NYSE:GS), are warning that investors should take advantage of the temporarily weak USD.

Today, we will be listening to speeches by Fed Chair Janet Yellen and IMF Managing Director Christine Lagarde at a panel discussion in Washington at 9:15 this morning. We will also get a taste of what’s in store for official job figures south of the border with the ADP Employment Change Report.