Japan’s credit rating is cut

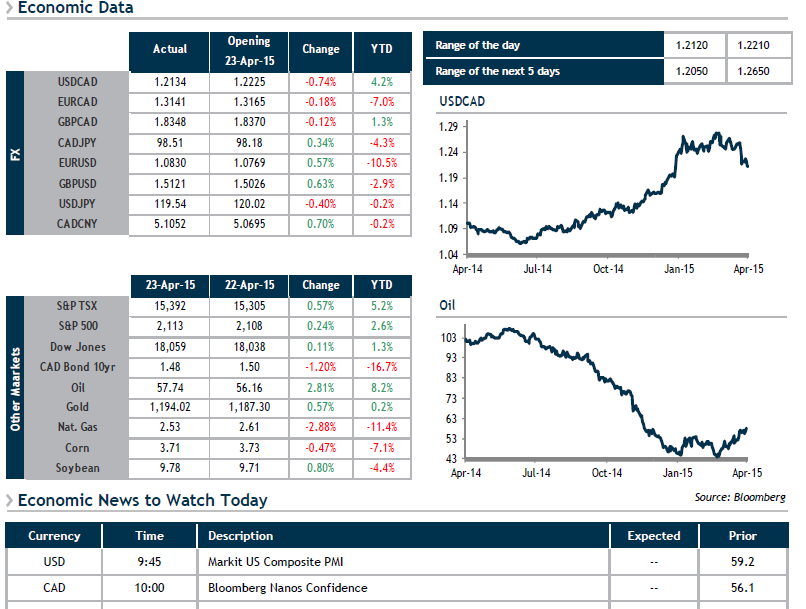

This morning, the loonie and crude oil prices are showing some signs of stability after having rebounded last week. Data released on Friday from oil driller Baker Hughes (NYSE:BHI) showed that oil rig counts plunged to their lowest level since October 2010, and this has not provided a lot of support for crude oil prices, as they still seem to be influenced by Middle Eastern geopolitical factors, with Saudi Arabia continuing to carry out an air campaign against Yemeni rebels.

Today, the Fitch credit rating agency announced that it had cut Japan’s credit rating, a few months after Moody’s had done the same. Fitch said in a note on Monday that the move "reflects the fact that the Japanese government did not include sufficient structural fiscal measures in its budget for the fiscal year April 2015-March 2016 (FY15) to replace a deferred consumption tax increase" and an increase in Japanese public debt. Consequently, the yen is falling against major currencies this morning.

In economic news, today we are awaiting the Markit Composite PMI in the U.S. and the Bloomberg Nanos Canadian Confidence Index here at home. We will also have the release of quarterly earnings for several large U.S. corporations, including Apple (NASDAQ:AAPL), and this will most likely influence markets. Lastly, let us also underscore the fact that the Montreal Canadiens won last night and are moving on to the second round of the playoffs!