Investing.com’s stocks of the week

U.S Retails sales release

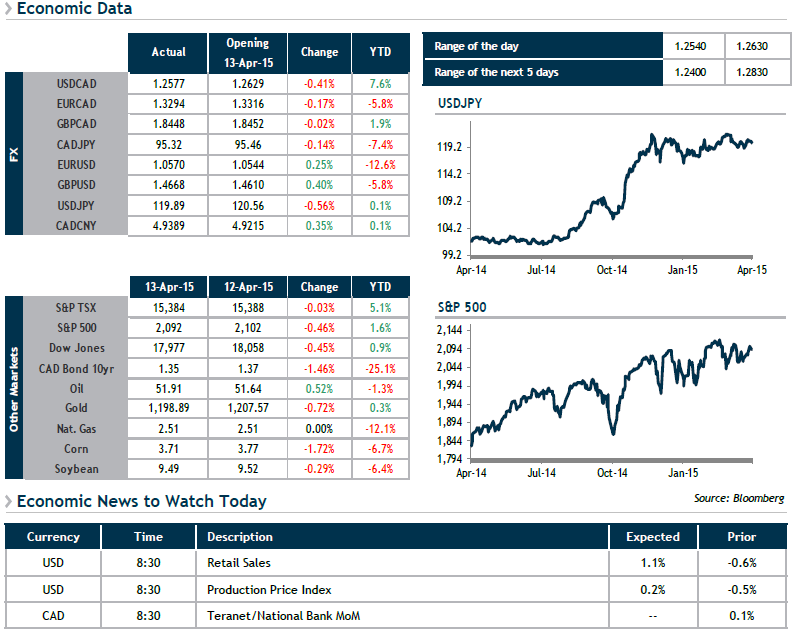

Koichi Hamada, an adviser to Japan’s Prime Minister Abe stated yesterday in a Bloomberg interview that the yen at a level around 105 would be appropriate. He also said that if it falls to 125 then that devaluation would be unjustified. The yen has lost more than 3% against the greenback in three years and is currently trading right below the 120 level.

Given that we are already in the second quarter, let’s take stock of the returns of some currencies since the start of 2015. Regarding the main currencies, only the Swiss franc has managed to appreciate slightly against the greenback. For their part, the loonie, the pound sterling and the euro have lost 7.7%, 5.85% and 12.6% of their valuation against the greenback respectively. This appeal for the U.S. dollar stems mainly from market expectations that the Fed will raise the key rate in 2015, combined with very accommodating policies from the other main central banks.

This morning we will be monitoring Retail Sales and the Producer Price Index in the U.S. In addition, there will be a speech given by William Dudley, President of the New York Fed. In Canada, we will have the Teranet National Bank HPI.