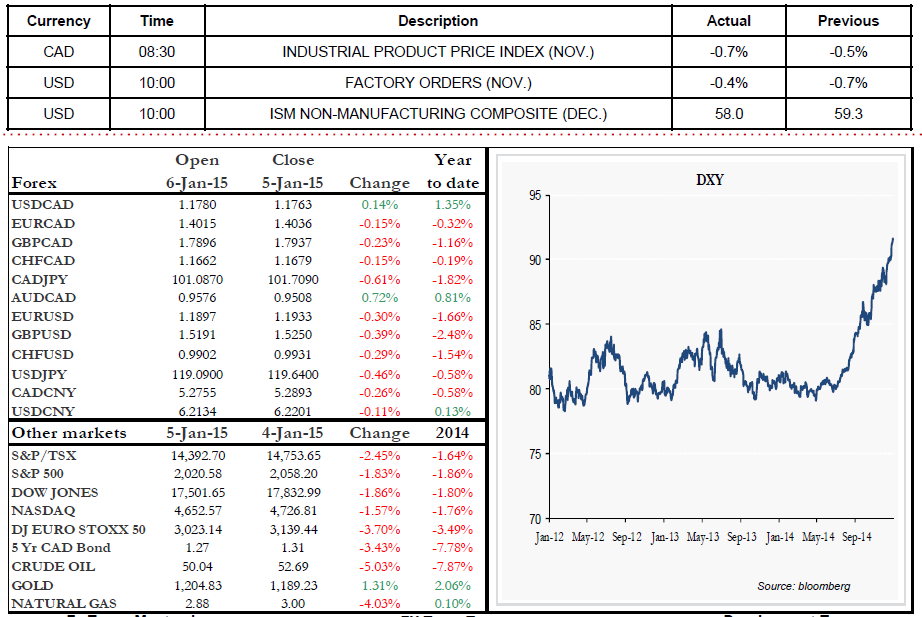

After having risen by 13% in 2014, the USD Dollar Index (DXY) is forecasted to increase by only 3.5% in 2015, according to a Bloomberg survey unveiled this morning that polled a dozen analysts.

• Stéfane Marion, our Chief Economist and Strategist, has revised his targets for the CAD against the USD to 1.20 by the end of 2015, taking into account a stabilization of crude oil prices at approximately $70 and a patient Fed that will not hike its key rate too quickly, given the global economic outlook.

• German inflation data that came in below forecasts yesterday (0.2% instead of 0.3%) confirmed to us that deflation risks remain significant in Europe, and other economic indicators released earlier this morning that concern the manufacturing and services sectors are pointing to a slowdown in European growth in Q4 of 2014. The euro is currently trading at its lowest level against the USD since 2006.

• Today, we will be monitoring the release of Factory Orders (November) and the ISM Non- Manufacturing Index (December) in the U.S. Wishing you a good day! Salim Laaroussi

• Range of the day: 1.17250– 1.1825 Range of the next 5 days: 1.1660-1.1900