Our screens were full of red yesterday, as the major stock markets continued to fall. WTI dropped by 4% and the S&PTSX fell by 2.4%. Since November 21, the pullback for Toronto’s exchange has reached 8.3%. Comments from Bank of Canada Governor Stephen Poloz caught our attention, as he stated that house prices are overvalued from 10% to 30%! In his opinion, high household debt levels coupled with inflated house prices pose a threat for the Canadian financial system. Despite these dire pronouncements, he nevertheless expects the Canadian economy to experience a soft landing.

In Europe, the European Central Bank (ECB) wants to restart credit by handing out 130 billion euros in cheap, long-term loans to financial institutions. The loan rate is 0.15%. It now remains to be seen if this will be enough to restart Europe’s economy. Should this program fail, then the ECB may move to buying sovereign bonds directly.

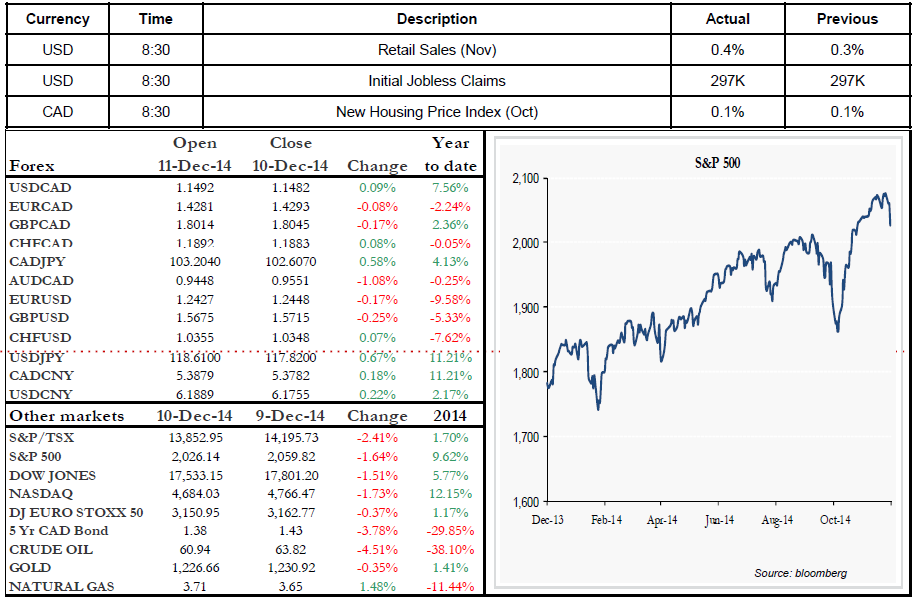

There are many economic indicators on the board today. At 8:30 a.m., we are awaiting Retail Sales and Initial Jobless Claims in the United States, while in Canada we will have the New Housing Price Index. Have a good day! Emmanuel Tessier-Fleury

Range of the day: 1.1410 – 1.1510

Range of the next 5 days: 1.1400-1.1600