Investing.com’s stocks of the week

Yesterday, the yen, the price of gold and U.S. bonds all posted gains because of economic concerns in China and political uncertainty in Greece. The Athens Stock Exchange (ASE) experienced its worst correction since 1987, falling by 12.8%. The Greek government announced that it would bring forward the date of the presidential elections to find the successor of Karolos Papoulias. This process is causing concern that the leftish party Syriza (Coalition of the Radical Left)—which is ahead in the polls—could be swept into power, because it opposes the austerity reforms imposed by the ECB, the EU and the IMF. In addition to hammering the ASE, this announcement also widened the credit spreads of eurozone countries.

Caution remains of the essence on markets, as the uncertainty resulting from the drop in crude oil prices is still being felt. The devaluation of the Russian rouble is increasing, and it is looking ever more difficult for Vladimir Putin’s government to stop this trend. The rouble has fallen by 61% since July 1st, and by 18% since November 24.

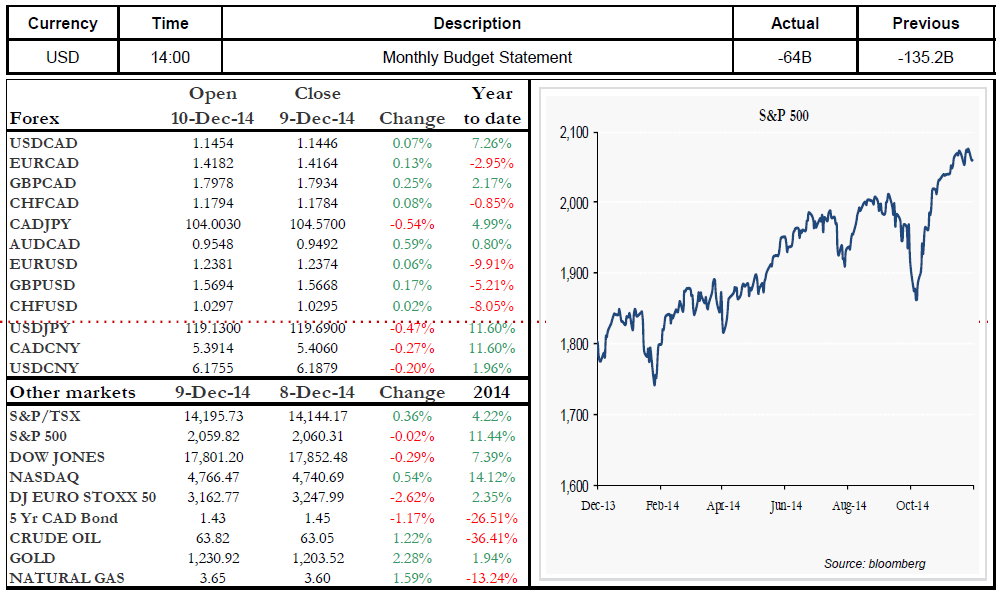

The loonie is pulling back slightly this morning, while Asian and European markets are rising.

Range of the day: 1.1410 – 1.1510

Range of the next 5 days: 1.1325-1.1540