In a departure from his recent habits, Bank of Canada Governor Stephen Poloz did not make an effort to reiterate his interest in favouring Canadian exporters through a weaker loonie when announcing yesterday’s rate decision, limiting his comments instead to stressing once again his fears regarding our debt levels while underscoring the economy’s progress. This may be because with the risks looming over the Canadian economy, particularly oil prices, Mr. Poloz believes that markets will take care of the loonie on their own without additional comments on his part.

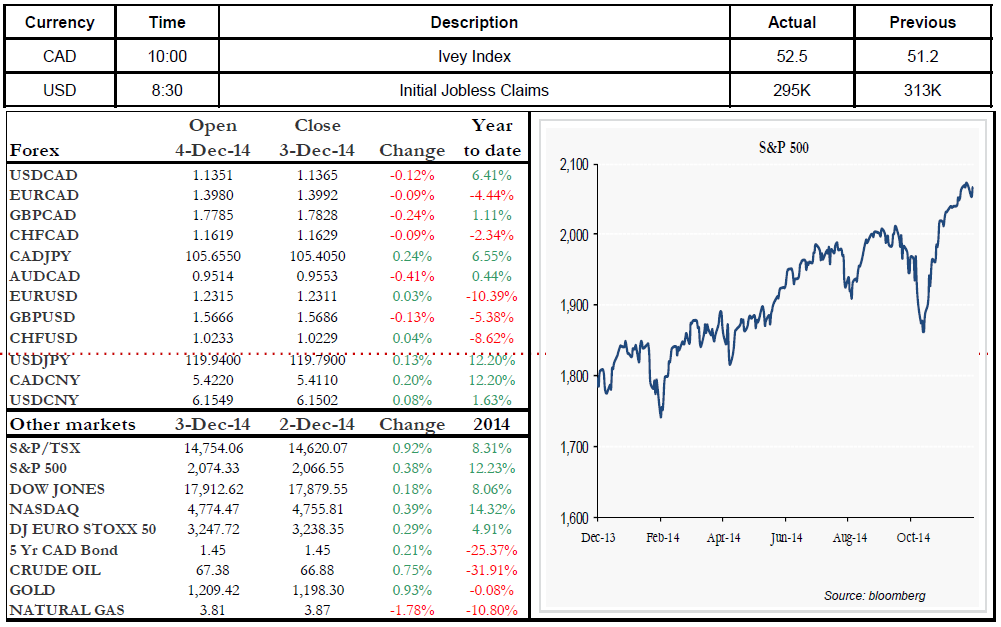

Meanwhile south of the border, according to the Fed’s Beige Book, the outlook is rosy everywhere. Consumer spending is up, inflation is in check, job creation is stable, in short, there is every reason to be optimistic. It’s therefore not surprising given this context that most stock indexes are at recent highs. It remains to be seen whether tomorrow’s jobs figures will further corroborate the positive situation.

Across the Atlantic, the Bank of England kept its key rate unchanged this morning, as did the European Central Bank. ECB President Mario Draghi is scheduled to speak at 8:30 and may go into greater detail on where ECB monetary policy is headed.

Range of the day: 1.1310 – 1.1440

Range of the next 5 days: 1.1250 – 1.1540