• The EUR/USD pair is finally starting to show signs of stabilizing after having retreated by 9% since last May. The European Central Bank (ECB) has just started implementing its asset purchase program. Its president, Mario Draghi, recently stated that he wanted to increase its balance sheet by roughly €1,000bn. The ECB has a lot of work to do to restart the eurozone’s economy, as the region’s unemployment rate is still at 11.6%, after having reached a high of 12% in June of 2013.

• The situation is quite different across the border, as the U.S. economy’s strength is boosting corporate earnings. Some 44% of the companies listed on the S&P500 having already announced their financial results, and sales and profits have risen by 4.72% and 8.78%, respectively. Fears that profit margins would be impacted by the strength of the U.S. dollar so far have not materialized.

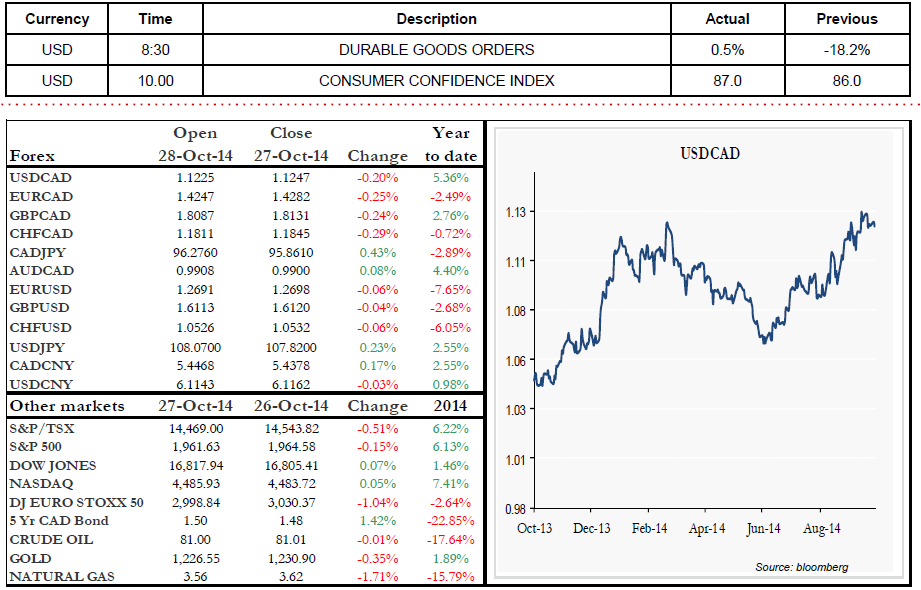

• Today’s economic indicators include Durable Goods Orders at 8:30 a.m., the S&P/Case-Shiller Home Price Indices at 9:00 a.m. and the CB Consumer Confidence Index at 10:00 a.m. Have a great day.

Emmanuel Tessier-Fleury

• Range of the day: 1.1185 - 1.1270

• Range of the next 5 days: 1.1100 – 1.1400