• Investors are optimistic once again, thanks to the fact that U.S. stock markets had their best week in a long time. Good corporate earnings and excellent U.S. economic data are fostering risk taking in the markets.

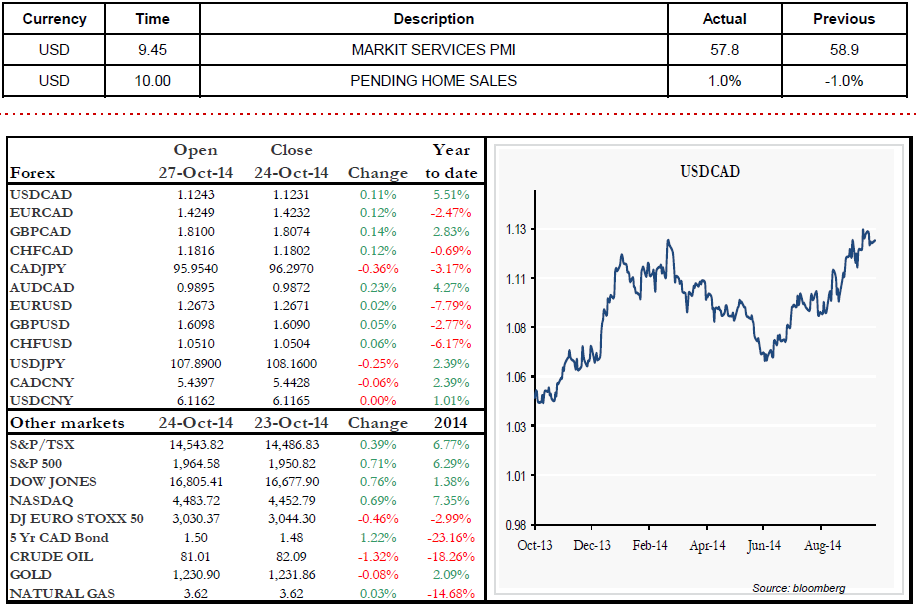

• This week, investors will be monitoring closely the meeting of FOMC members to be held Tuesday and Wednesday. Even though markets are fully discounting that the bond-buyback program will come to an end, the statement that will accompany the decision rendered by the FOMC, as well as GPD data that will be released on Thursday will have the largest impact on stock, bond and currency markets. We expect a lot of volatility for the USD/CAD pair, which is still close to its recent high.

• Today, we are waiting for the release of the U.S. Flash PMI at 9:45 a.m., as well as Pending Home Sales at 10:00. German business climate figures released last night were at their lowest in close to two years, and this is weighing down on commodities and markets. The loonie is stable this morning. Have a great day. Emmanuel Tessier-Fleury

• Range of the day: 1.1195 - 1.1285

• Range of the next 5 days: 1.1100 – 1.1400