Investing.com’s stocks of the week

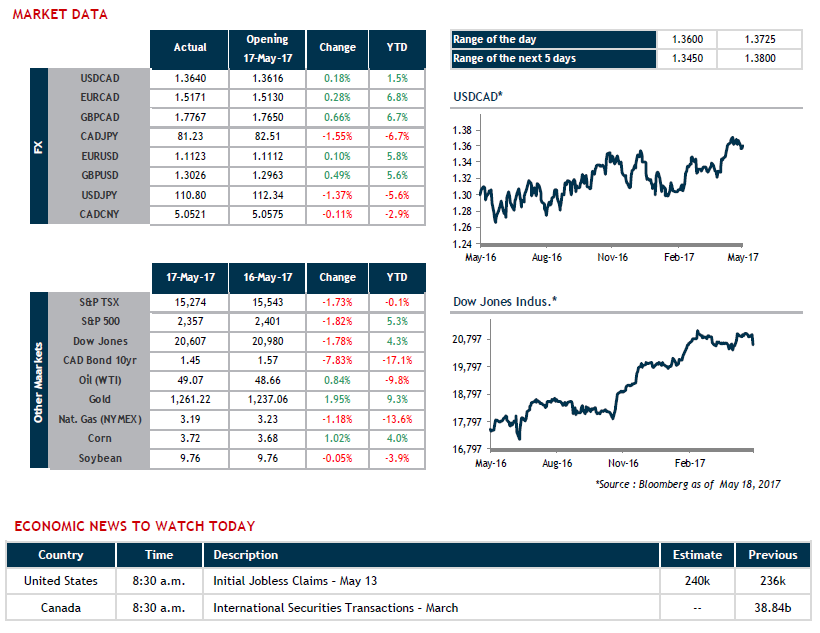

The U.S. Dollar Index (DXY), which measures the greenback against the other major currencies, has officially given up all of the 6% gained since the U.S. elections, in large part to the benefit of the euro and the yen. Stock markets dropped close to 1.8% yesterday, but remain close to historic highs.

Canadian Manufacturing Shipments announced yesterday were not as high as expected, however increased sales and inventories confirm that factories contributed to economic growth in March. Our economists estimate that Canadian Gross Domestic Product data, which will be released at the end of the month, could show annualized growth of 3.5%. Stay tuned if Retail Sales confirm this strength tomorrow. In the meantime, the economic indicator calendar is sparse.

Our screens are red this morning, with stock markets and WTI oil in negative territory. Investors in search of safety are fleeing to the yen and U.S. dollar. The Canadian dollar will no doubt be under pressure in this troubled context.