U.S. key rate hikes increasingly likely

Statistics Canada had a major surprise for us on Friday, confirming that the economy picked up 53,700 jobs in December after a loss of 2,500 positions had been projected. Considering the major volatility in the change in full-time positions from one month to the next, it is a little too soon to draw a conclusion from Friday’s results.

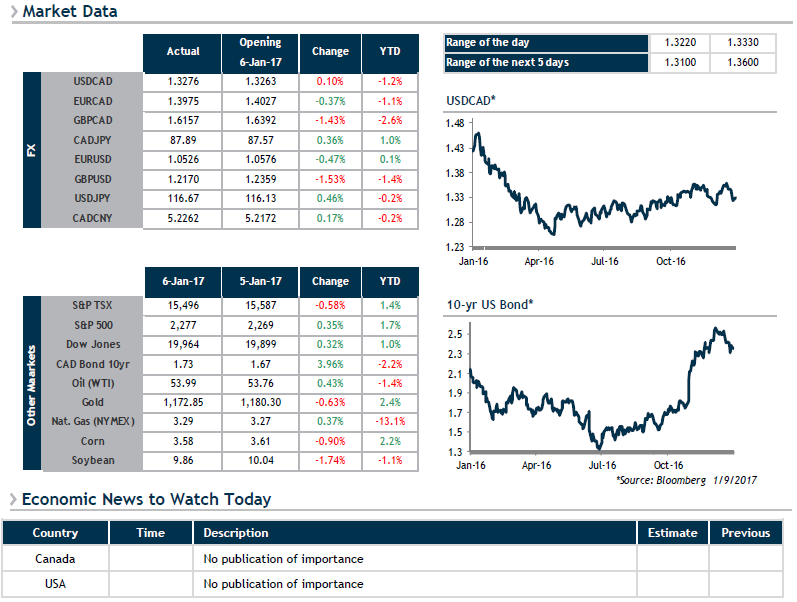

This may be the reason that the loonie was unable to go it alone for very long given the greenback’s ascent against the other major currencies. The news that U.S. job creation for December was at an acceptable level (+156,000) combined with the finding that there was upward pressure on wages quickly brought the U.S. dollar into favour. For the moment, a key rate increase in June is the most likely scenario, but a move in March cannot be ruled out.

In the meantime, United Kingdom Prime Minister Theresa May has confirmed that Brexit remains among her priorities as does regaining control over immigration. As a result, the GBP was among the biggest losers, posting a drop of more than 1%.