Investing.com’s stocks of the week

Italian lawmakers agreed yesterday to set aside up to €20 billion to support the country's banks as they struggle with financial problems. At the top of the list is Monte dei Paschi di Siena, the third largest lender in Italy, which until now has been unable to find €5 billion in additional capital from private investors and had expected to exhaust its liquidity within 4 months. The euro has gained ground on the news, but still remains very close to its lowest point in the past two years.

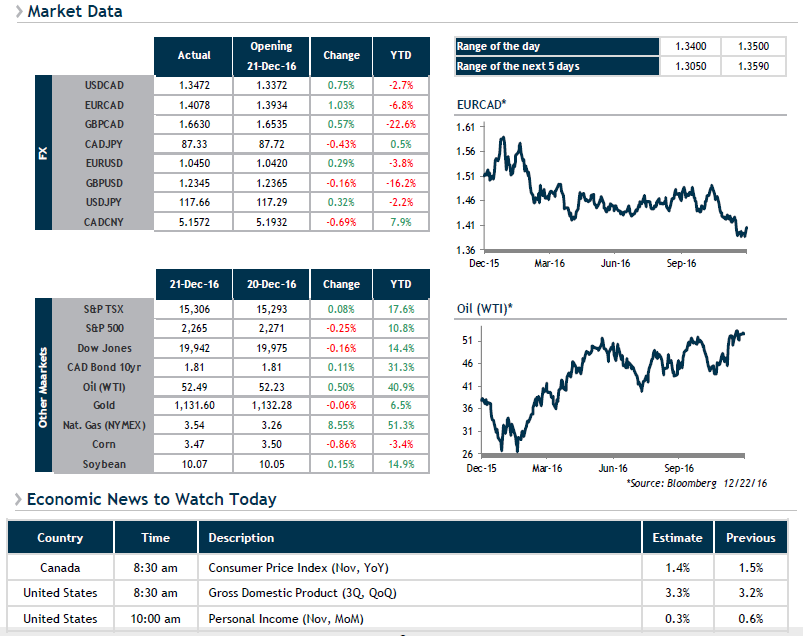

The agenda is awash in significant indicators this morning. In the United States, we'll be keeping an eye on Q3 Gross Domestic Product (GDP) numbers, Durable Goods Orders, Initial Jobless Claims, Personal Income and Leading Indicators. In Canada, Inflation and Retail Sales data are on deck. The CAD, which has already lost a fair amount of value further to the increase in U.S. Oil Inventories announced yesterday, could continue to slump this morning.