Bank of Japan stays the course

The last word for 2016 fell to Japan’s central bank, which used the opportunity to strike a more upbeat tone on the country’s economic growth but kept its market intervention programs as is, repeating its intent to hold 10-year bond yields close to 0%. The yen continued its slide, down close to 10% since the U.S. election on November 8.

In the coming days, we will no doubt be awash in details on the appalling events of the past few hours, but for the time being, world stock markets do not appear overly concerned. Although stocks are in the green, foreign exchange markets are still favouring the USD, driving it to its highest level since 2003 against its peers.

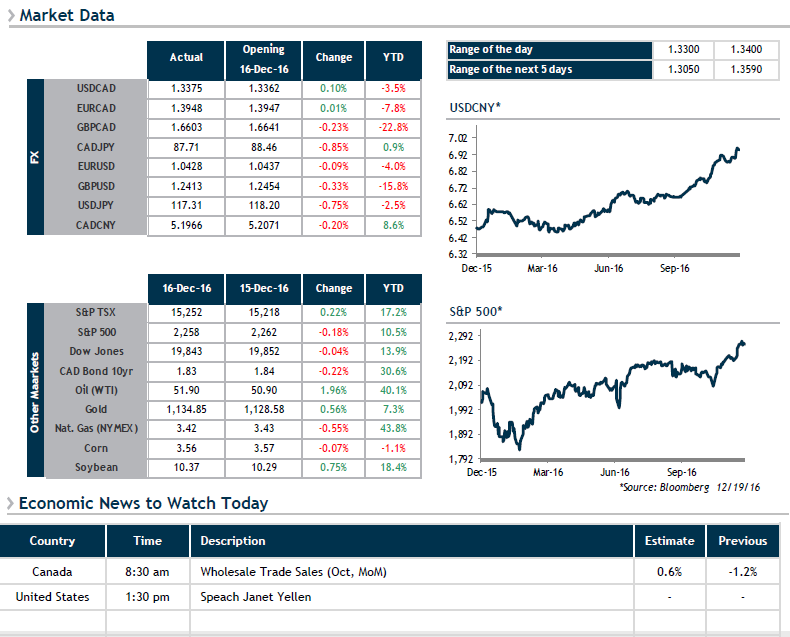

The only news of importance this morning will be Canadian Wholesale Sales for October at 8:30. Observers expect an increase of 0.5% compared to the previous reading of -1.2%. However, it would be surprising to see this indicator reverse the trend seen in recent days.