Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

U.S. Federal Reserve maintains its credibility

To no one’s great surprise, the U.S. Federal Reserve (Fed) delivered on a 25-bp key rate increase. However, markets were shaken up by the fact that eleven out of seventeen Fed voting members anticipate at least three rate hikes next year. Calling the rate increase a vote of confidence in the U.S. economy, Fed Chair Janet Yellen denied criticism that she had been late in removing stimulus measures and stressed that additional tightening will be modest.

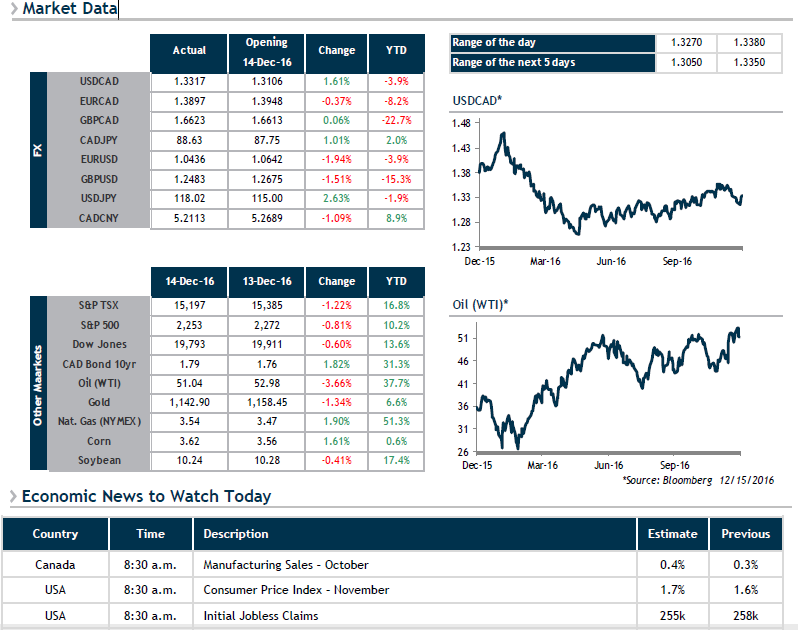

Naturally, the news sent the greenback soaring against its peers. The loonie is down more than 1.5%, giving up in one trading day the ground it had won over the past nine. U.S. stocks, crude oil and gold all fell, while the U.S. yield curve steepened further.

We’re learning this morning via the Wall Street Journal that Iraq intends to raise its oil exports in January. In comparison to October export levels, this would represent a 7% increase for the country. This development immediately raises numerous questions regarding the viability of the recent agreement between OPEC and other oil-producing nations.

Market Data