Euro records gains!

After Friday’s jobs data and the referendum in Italy, investors’ attention will now shift to the Bank of Canada (BoC) and the European Central Bank (ECB), which are meeting for one final time in 2016. The BoC’s key rate decision is scheduled for Wednesday morning at 10 a.m. and it will be interesting to see the comments that accompany it. Since the U.S. election, Canadian bond yields have risen sharply and investors are now pricing the likelihood of at least one Canadian key rate increase in 2017 at 45%.

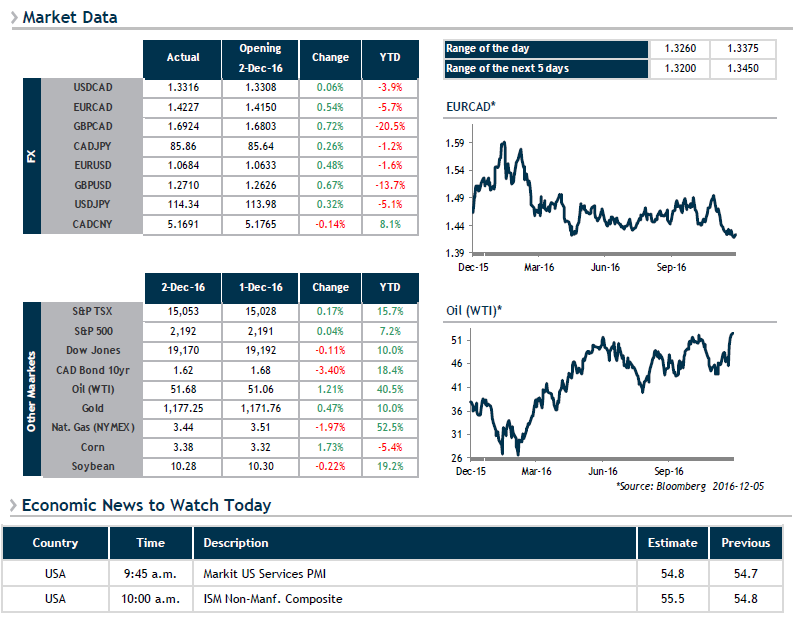

The victory of the “no” side in the Italian constitutional referendum and the resignation of Prime Minister Matteo Renzi are favouring the euro, which is up against all its major counterparts. The euro has gained 2% on the greenback since last night’s low and European stock exchanges have also seen gains.

Crude oil prices have just seen their best week in several years. The agreed-upon production cut from OPEC member nations in cooperation with Russia is positive and allows us to believe that Brent and WTI oil prices will stabilize above $50 a barrel.