Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Canadian dollar hanging on

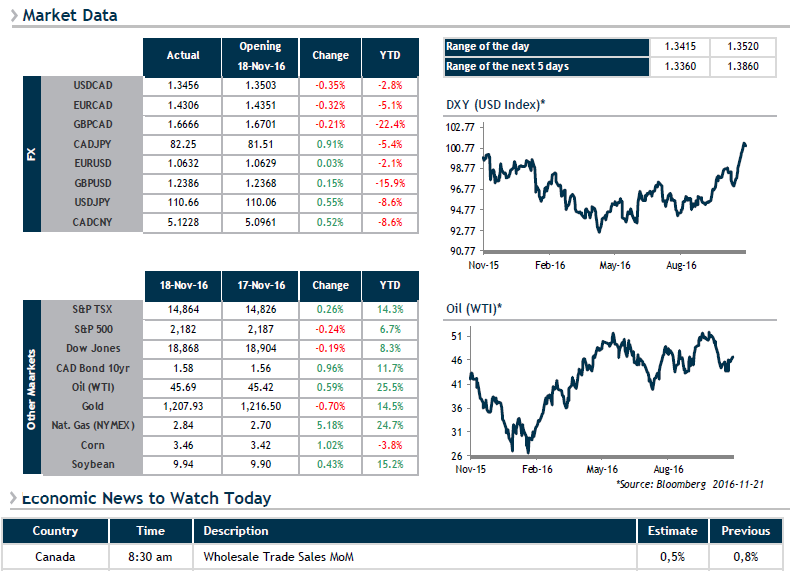

Since Trump was elected, the U.S. dollar (USD) has gained so much against the other major currencies that it has reached highs unseen in nearly 13 years. The Canadian dollar (CAD) has obviously been affected but is nonetheless putting up an impressive fight that many traders and analysts are having trouble explaining. Last week, the loonie was the only major currency that made gains against the USD.

According to some economists, including those here at National Bank, Trump’s rhetoric regarding NAFTA, expansionary U.S. monetary policy, interest rate movements and the divergence between U.S. and Canadian monetary policies could lead to a weaker CAD. In concrete terms, we could expect a slight dip in the CAD in the next few months before then seeing some measure of stabilization. Given such a context, if you are a USD buyer, the old adage “Buy when it drops” that our trader colleagues are fond of (sometimes overly so), appears to be well founded.

Today, the slate of economic indicators is relatively sparse in North America, however we will be paying attention to developments in Vienna, where OPEC members are meeting.