Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

U.S. dollar stays strong

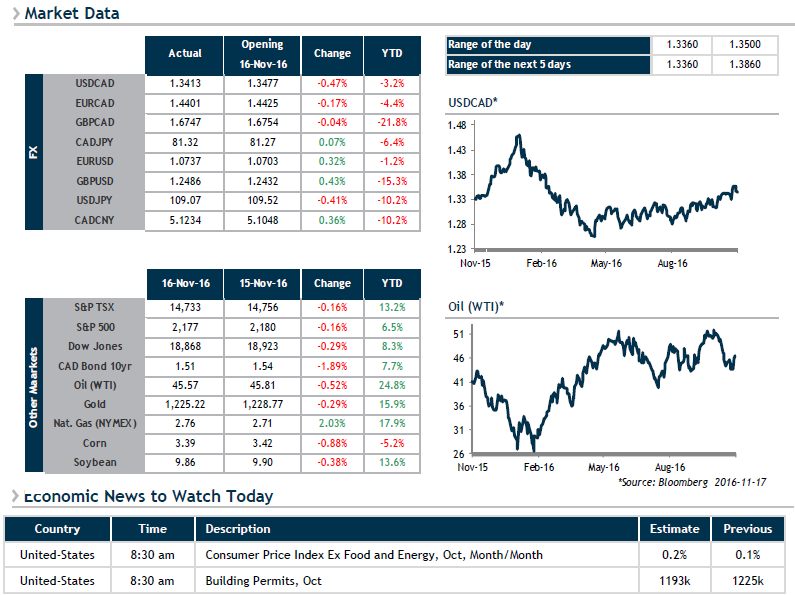

The diverging monetary policies between the United States and Canada are such that we continue to think that our currency is vulnerable. As our Chief Economist and Strategist Stéfane Marion pointed out in his November 10 webinar (which can be accessed via our website), the market does not appear to be sufficiently concerned about a possible renegotiation of NAFTA. Anticipations of a 25-basis-point interest rate cut are non-existent for 2016 and less than 20% for next year! If markets were to lend greater credence to such a possibility, the Canadian dollar would be negatively impacted.

Given this context, the current corrections, which are being attributed to rumours and statements regarding a possible crude oil production freeze at the end of November, could represent attractive opportunities for USD buyers.

The diverging monetary policies between the United States and the eurozone are also significant and the euro is losing a great deal of ground.

Today and tomorrow will be chock-full of economic data, with U.S. inflation playing a starring role this morning and Canadian inflation on deck tomorrow morning.