Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

The oil effect, an opportunity for importers?

Although we had thought that the influence of crude oil prices (WTI) on the CAD had faded, yesterday’s trading day proved the contrary.

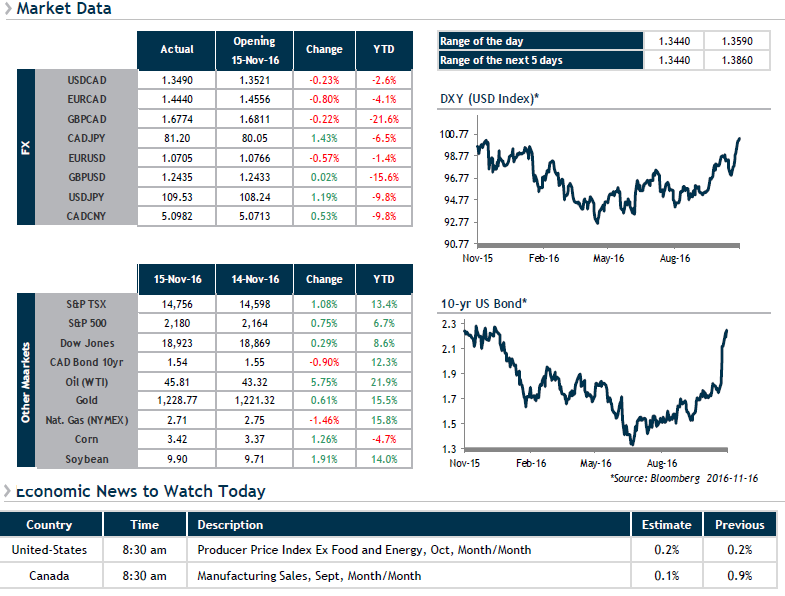

Early in the session, the release of much better-than-expected U.S. Retail Sales data had sent the USD rising, besting its levels from the previous day against the yen, euro, pound sterling and Swiss franc. However, against the CAD, the opposite situation prevailed. Our currency gained around 100 points over the course of the session, rising along with WTI prices. The 6% increase in crude oil was due to rumours of an agreement on production freeze levels. The members of OPEC (Organization of Petroleum Exporting Countries) will hold an official meeting on November 30 in Vienna. In September, the organization had succeeded in reaching an agreement to stabilize prices. However, since then, a great deal of dissent has resurfaced within the cartel and WTI prices have begun to slide again.

Yesterday’s decline in the USD/CAD pair appears to be more a correction than a shift in the trend. USD buyers may want to take advantage of it.