The pulse of the Canadian economy on the agenda

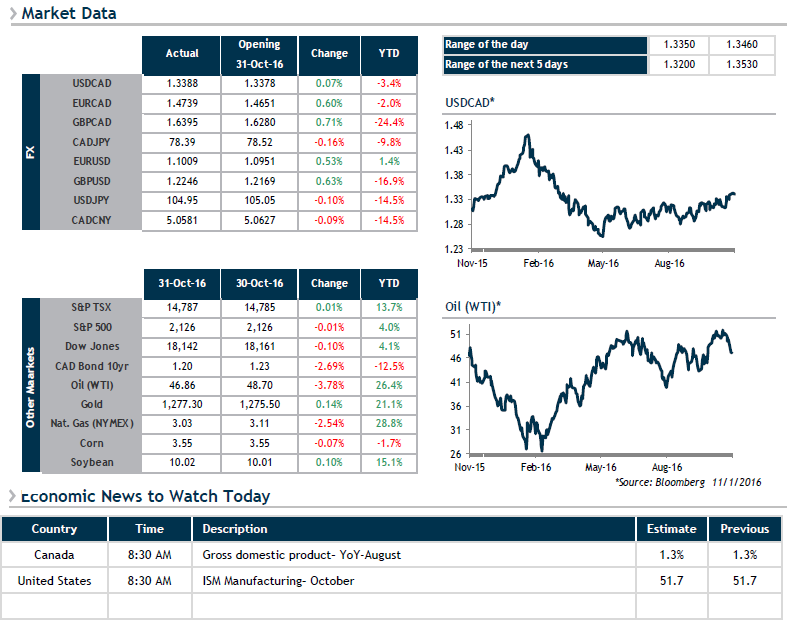

Market observers were clearly disappointed yesterday with another round of fruitless talks in Vienna on oil output. Anticipations that OPEC member nations and other producers will eventually reach a significant agreement have faded away to the extent that WTI oil prices gave up close to 3.8% yesterday and are only showing a slight rebound this morning.

The announcement from China that the country’s Manufacturing PMI reached a two-year high in October at 51.2 may have revived some measure of hope that global oil consumption will firm up. Moreover, given that this is the third straight month that this indicator has risen, this morning’s reading appears all the more credible.

Surprisingly, the loonie continues to uncouple from oil price movements as changes to Canadian and U.S. monetary policy appear to be the driving factor at present. This morning, we’ll be keeping a close eye on our GDP reading for August. Bank of Canada Governor Stephen Poloz will also be speaking in Vancouver at noon, although he will not be taking questions from the press until 1:15.