Investing.com’s stocks of the week

Peak political uncertainty

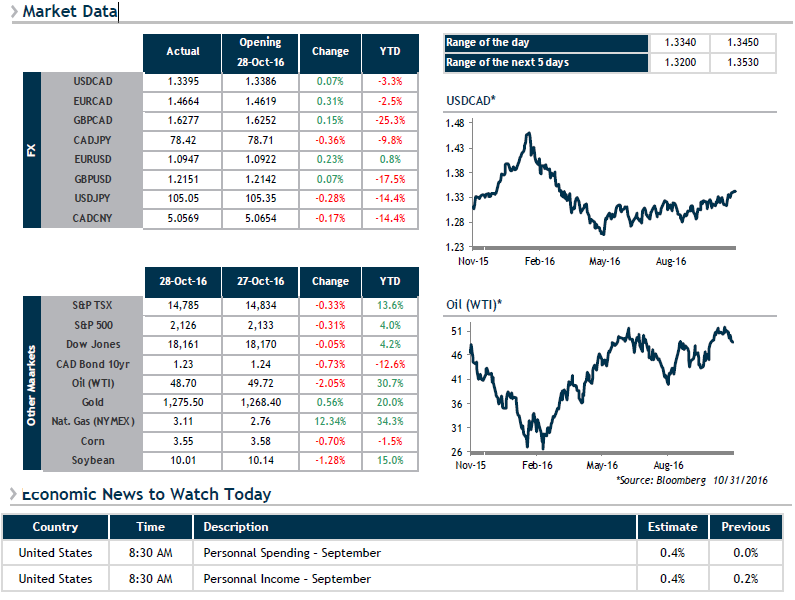

Friday’s announcement by the FBI that it was reopening its probe into the much-discussed emails of presidential candidate Hillary Clinton has shaken up stock markets, driving them down and adding strength to the greenback. The USD was already bolstered earlier in the day by the release of solid U.S. GDP data, which added to the anticipations of a key rate hike in December, sending it to its highest point against our dollar since March. It’s now just over a week until we learn the outcome of these far-from-boring U.S. elections on November 8. For the moment, the most recent ABC survey has Ms. Clinton leading Donald Trump by a single percentage point at 46% to 45%.

This week will also be highly interesting, particularly for Canada, as a number of indicators such as GDP and Trade Balance will give us a clearer picture of how our economy is faring. The highlight will obviously be the release of job data on both sides of the border on Friday.

This morning, we begin the trading day with crude oil falling as hopes for an agreement between OPEC member nations and other oil-producing countries have led to the announcement that yet another meeting will be held in November on the subject. For the time being, the impact on the loonie of WTI oil at $48.40 a barrel is limited, but all things being equal, it’s hard not to say that the context as a whole favours the greenback.