A clearer picture for December emerges

The release of the minutes of the most recent U.S. Federal Reserve (Fed) meeting took on a singular importance as investors appear to be reviewing their expectations regarding a potential tightening of U.S. monetary policy. Some important points to bear in mind:

• Several members were prepared to raise rates, but finally decided to await additional data points

• Inflation below the target and low salary growth remain concerns

• Considering recent economic indicators, other delays in tightening monetary policy could harm the Fed’s credibility

Certain analysts have noted that the U.S. data released since the most recent Fed meeting should be sufficient for a key rate hike in December. Third quarter GDP and October and November job data will be the key points to watch before the decision.

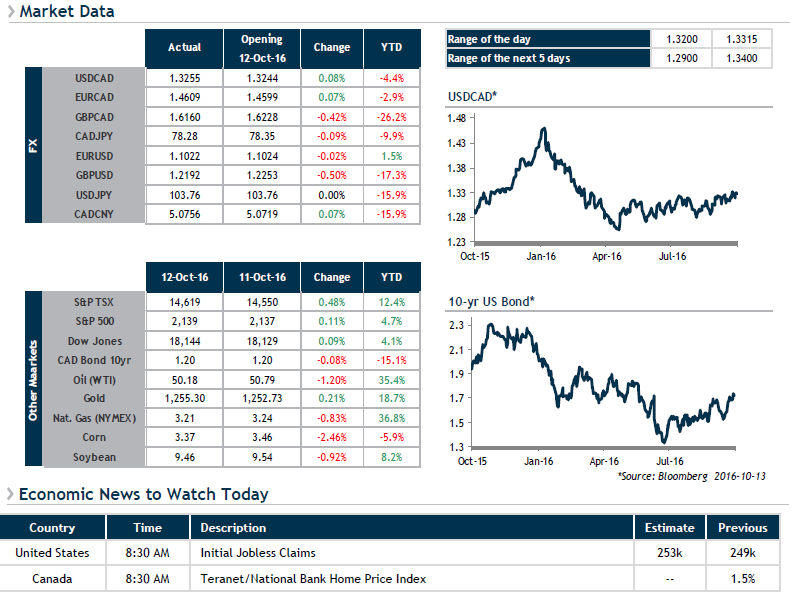

This morning, safe havens are enjoying another moment in the spotlight, as Chinese exports were genuinely disappointing. A new wave of uncertainty from China could favour the USD. Given this context, the USD/CAD pair could move out of its recent range. Vigilance will be key!

Today, we’ll be keeping an eye on the Teranet-National Bank Home Price Index.