Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Demand for U.S. dollar remains strong

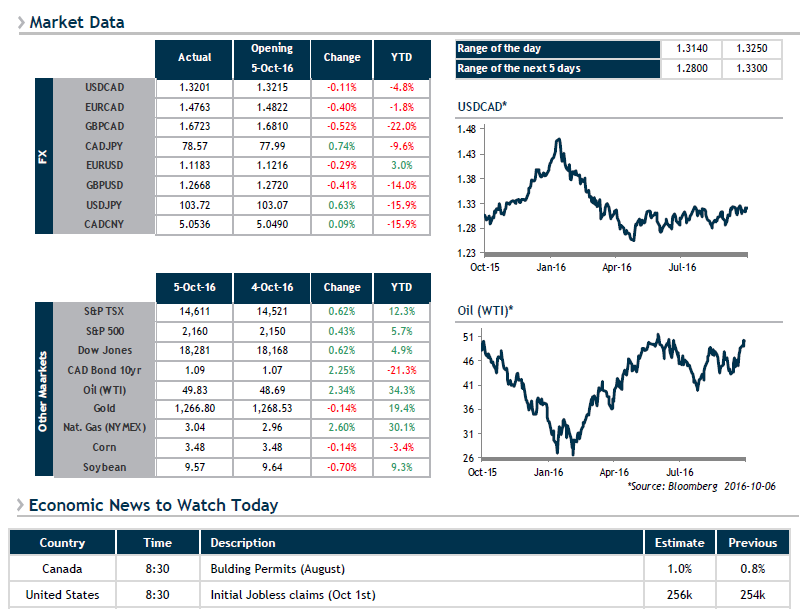

The numerous U.S. economic indicators released yesterday beat market expectations on the whole, including Factory Orders, the ISM Non-Manufacturing Index and the Markit US Services PMI. Despite a slightly disappointing reading for the number of U.S. private sector jobs created, the USD remained strong all day, particularly against the yen.

However, its increase against the Canadian dollar was halted immediately after crude inventory data showed a sharp decline. Oil prices (WTI) then rose, reaching $49.97.

We therefore find ourselves in a similar situation to yesterday, where the more time passes, the more sensitive the USD is to economic data. With a few weeks to go until a potential key rate increase and one day before Friday’s job data, volatility will still remain very much a reality.