Pound sterling plunges sharply (cont.)

The pound sterling’s slide continued throughout the day on Tuesday. Against the U.S. dollar, the spot rate dipped briefly below 1.2700, meaning we have reached levels not seen since the mid-80s when Margaret Thatcher was U.K. Prime Minister…

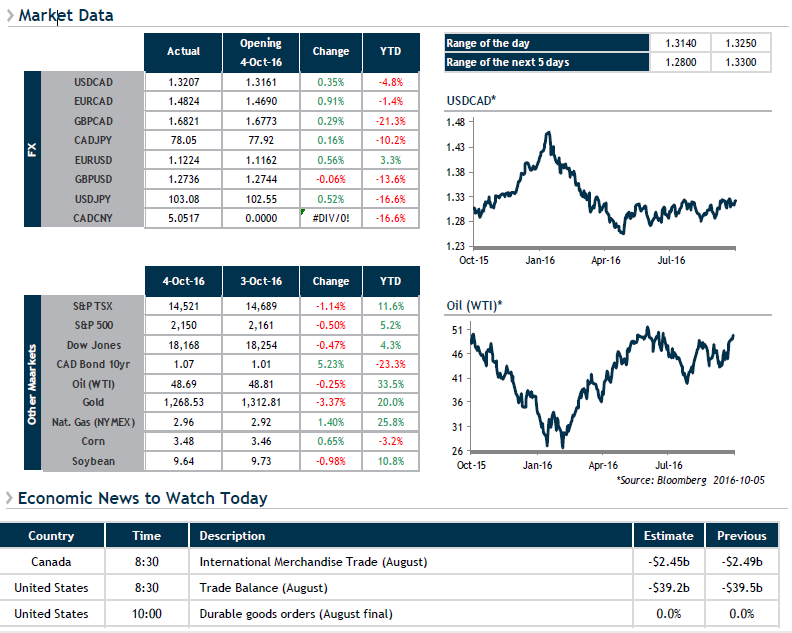

In Japan, the yen is also under pressure. The Bank of Japan has confirmed that it is prepared to cut interest rates if the need is there. Early this morning, the JPY was trading at 103 against the greenback.

There was generalized demand for the U.S. dollar yesterday against numerous currencies. Markets are upbeat about the greenback due to the approaching key rate increase in the United States and the release of job data on Friday. The continued climb in oil prices, with WTI now solidly entrenched above $49, has yet to strengthen our dollar, meaning attractive opportunities may arise for exporters.

This morning, we’ll be keeping an eye on both U.S. and Canadian trade balances.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.