A highly active end to summer!

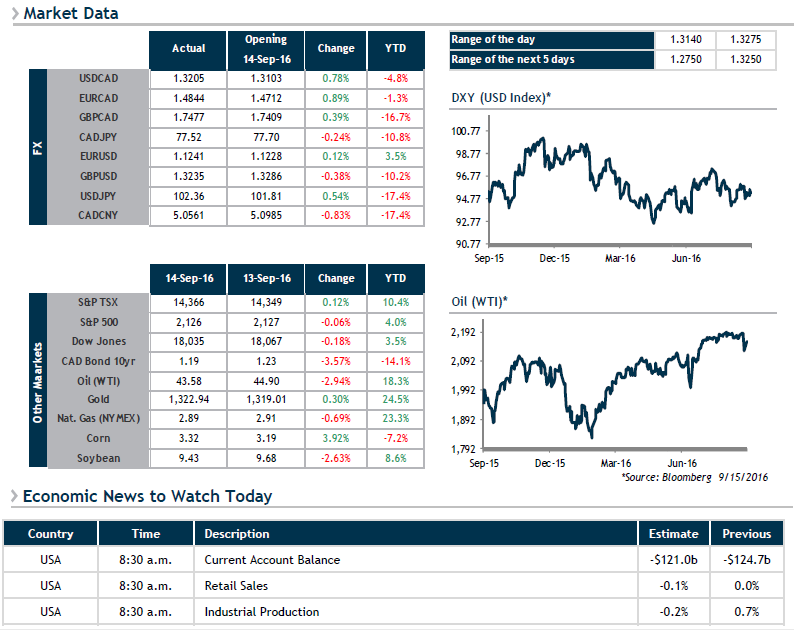

Crude oil saw another rough day yesterday further to the release of U.S. petroleum product inventories, which showed a larger-than-expected increase in distillate inventory. It should be noted that the major oil-producing nations will meet from September 26 to 28 to discuss a potential production freeze.

It will be interesting to see whether the Canadian dollar can break through the resistance level just above 1.3200 and in so doing, take us out of the 1.2700-1.3230 range where it has remained for the past several months.

Several economic indicators are on tap in the United States this morning and we expect another eventful day for our various teams. We will be keeping an eye on Retail Sales, Industrial Production and the Empire Manufacturing Index for New York State. It will also be interesting to see the impact of comments from the Bank of England, which said this morning that it was prepared to cut its key rate again. Our clients should take advantage of this volatility to place orders, both on the currency market and for interest rates and commodities. Have a great day! Emmanuel Tessier-Fleury