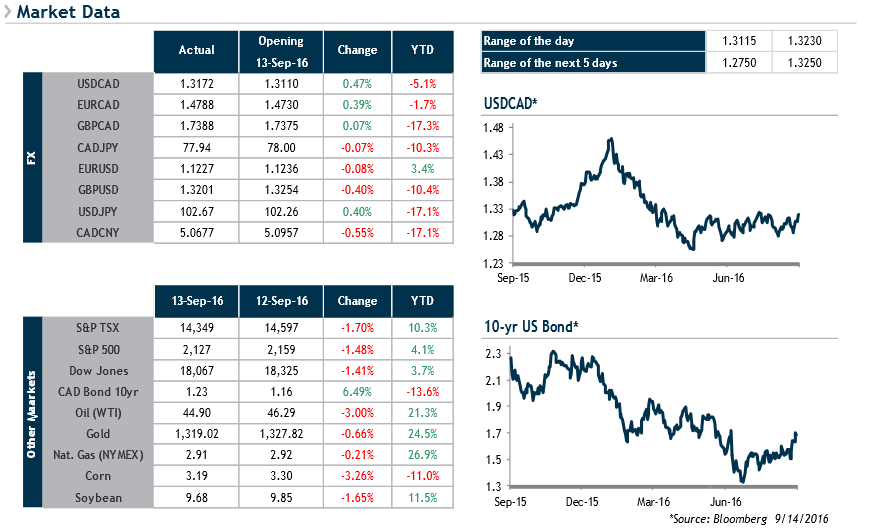

The Canadian dollar had a rough day yesterday, as WTI oil fell 3%. The decline in crude oil prices coupled with anticipated monetary tightening by the Fed is also being felt on currencies from emerging nations. Over the past month, South Africa, Mexico and Brazil have seen their currencies slide by 5.8%, 4.5% and 3.6% respectively.

The current context is also difficult for investors and pension funds, as the possibility of tighter U.S. monetary policy is simultaneously weighing down bond and stock markets as well as commodity prices. In fact, the correlation between the S&P500 Index and U.S. 5-year bonds is a meagre -9% over the past 6 months. It should be noted that this correlation stood at -42% and -35% respectively for the past 12 and 36 months. The bond market may not be as secure as many believe!

The increase in volatility favours the U.S. dollar and is providing an attractive opportunity for companies that export to the United States to adjust their hedging policy.