Investing.com’s stocks of the week

Our screens are awash in red this morning as European and Asian markets are down significantly. The correction also continues in crude oil as the futures market is pointing to a bearish opening for North American stocks. The possibility that the U.S. Federal Reserve (the “Fed”) could tighten its monetary policy more quickly than expected coupled with the hesitation from the European Central Bank (“ECB”) are serving as the pretext for the correction. It is difficult for investors to seek shelter from the current storm, with troubles in the bond market as well.

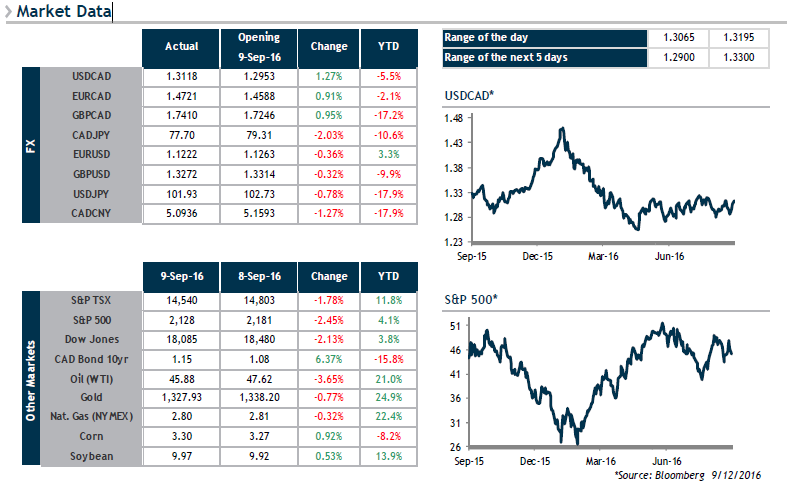

This wave of panic is favourable for the U.S. dollar, which is gaining ground against most of its major peers. Our clients who export to the United States should take advantage of this opportunity to place orders with our team. We could finally see a breakthrough on the resistance level on the USD/CAD pair, which is just above 1.3200!

A great deal of volatility is still to be expected as we await comments from three influential Fed members. No economic news of importance is on the calendar today.