After-affects continue to accumulate

As the U.S. dollar attempted to recover from its rough ride last week, it suffered a further setback on Tuesday morning. The Institute for Supply Management (ISM)’s services index for August fell to its lowest level since 2010. The U.S. Dollar Index (DXY), which measures the value of the U.S. dollar against the other major currencies, dipped close to 1% Tuesday.

These disappointing indicators force observers to once again question where interest rates are headed in the United States, even though FOMC members are stressing that the Fed will move forward with a tighter monetary policy.

The likelihood of a key rate increase at any of the next three Federal Reserve meetings has dropped sharply over the past week. The updated chances are now as follows (source: Bloomberg, September 6, 2016, with the chances as at September 1 in parentheses):

- September 21: 24% (34%)

- November 2: 27.3% (39.7%)

- December 14: 51.8% (59.8%)

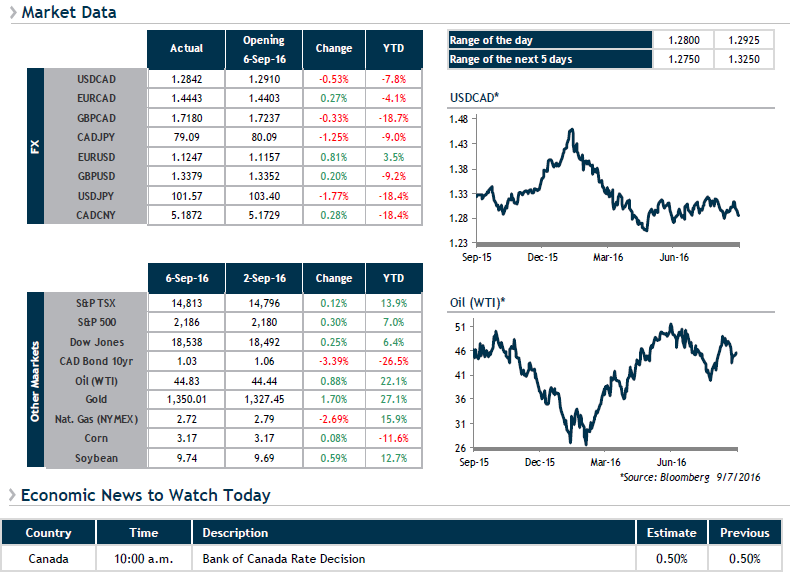

At 10 a.m., we’ll be keeping an eye on the Bank of Canada’s key rate decision, where the status quo is expected to prevail.