Waiting for Jackson Hole

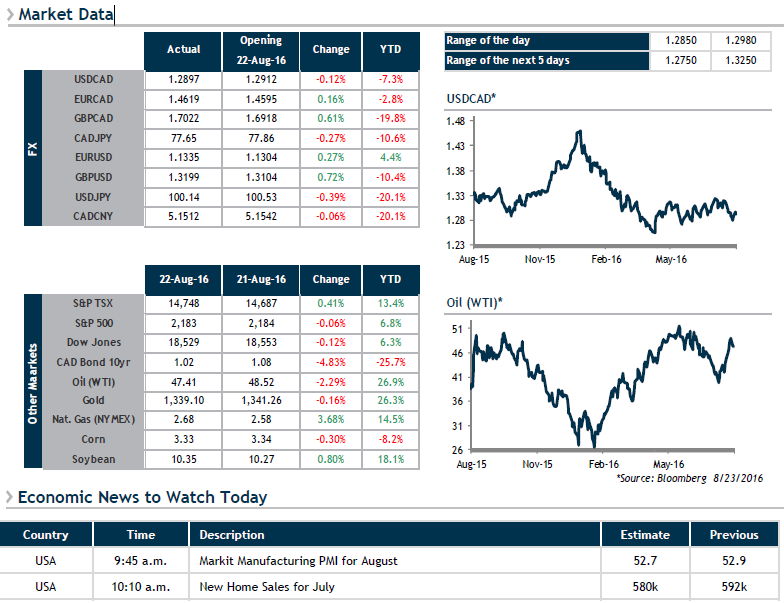

Despite Canadian Wholesale Sales that came in well above expectations for June (+0.7% vs. +0.1%), the Canadian dollar (CAD) dipped slightly. We are experiencing a downward correction in oil prices (WTI), which had seen a 20% increase in August.

Currency market participants appear to have been paying attention to Sunday’s speech by U.S. Federal Reserve Vice-Chair Stanley Fischer, who confirmed that the U.S. economy was close to the objectives set by the Fed. Nevertheless, investors remain doubtful about an interest rate hike this year. The following are the probabilities of a rate increase at each of the next three Fed meetings (source: Bloomberg, August 23, 2016):

- September 21: 24%

- November 2: 30% (less likely as elections will be held on November 8)

- December 14: 51%

The Fed has been telling us for months now that its monetary policy decisions will be dictated by upcoming economic data. Among these are naturally job data, for which the next reading is Friday, September 2. In the meantime, the speech by Fed Chair Janet Yellen this Friday in Jackson Hole, Wyoming will attract a great deal of attention.