As we start off this week, it feels like vacation season is almost over, and like the Canadian dollar (CAD) is subject to two opposing forces.

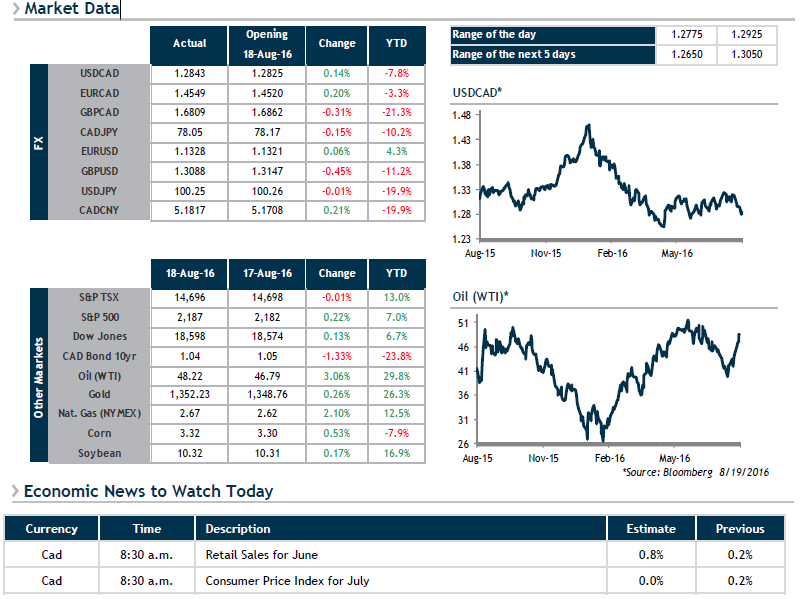

At one end of the rope, the CAD is being pulled upward by the price of oil (WTI), which has risen from $40 to $48 in less than 30 days, as well as record net flows of foreign capital to Canada. In a universe of low (or sometimes even negative) yields, global investors are finding the returns they're looking for in Canadian bonds, meaning they need to buy Canadian dollars.

At the other end of the rope, recent Canadian economic fundamentals are showing signs of weakness, such as lacklustre job data, retail sales and trade balance as well as inflation to a lesser extent.

Over the summer, WTI prices were able to pull harder on the rope than economic fundamentals. We believe that this trend could fade and even reverse this fall.

On the menu this week: Canadian Wholesale Sales today, American Q2 GDP Growth on Friday and most importantly, Fed Chair Janet Yellen's speech in Jackson Hole also on Friday.