Investors question Fed’s intentions

The U.S. dollar continued to drop Tuesday, as investors have serious doubts that the Fed will move forward with a tightening of its monetary policy later this year. Yesterday’s U.S. inflation data didn’t help the greenback’s cause, with July’s Consumer Price Index flat, confirming there is very little inflationary pressure.

New York Federal Reserve President William Dudley attempted to mitigate this skepticism Tuesday in a televised interview, confirming that the Fed could still raise rates in September. Dudley added that the U.S. economy could improve in the second half of 2016 and that the upcoming presidential election would not impact the Fed’s decision. These comments by Mr. Dudley come nine days before the world’s major central bankers meet in Jackson Hole, an event used to announce monetary policy directions.

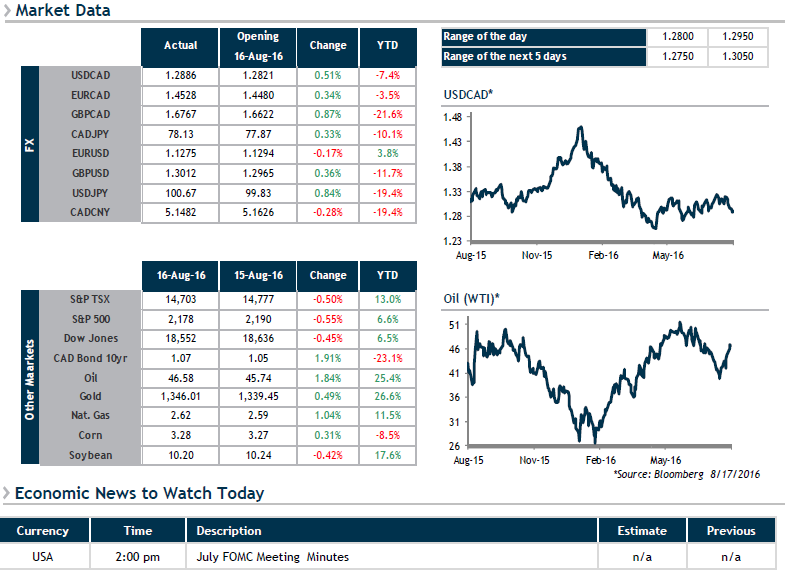

Today, we’ll be keeping an eye on the release of the most recent Fed meeting minutes. Stocks are down slightly this morning and the greenback appears to be making an attempt to win back some of the ground lost since the beginning of the week.