Investing.com’s stocks of the week

Oil demand expected to weaken

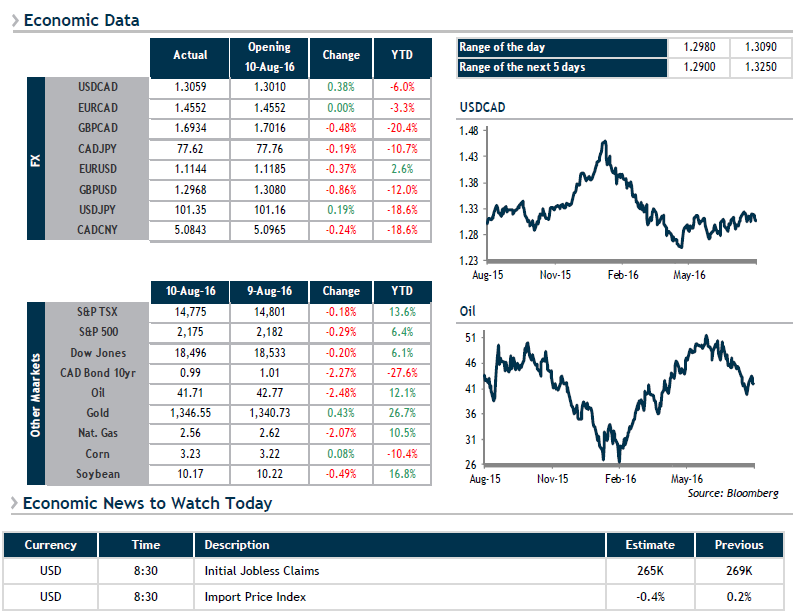

Crude oil had a rough ride yesterday further to the release of data showing higher-than-expected inventories in the U.S. Vacation season is coming to an end and high stockpiles could decrease demand for oil in the coming weeks, continuing to apply downward pressure on prices. Contrary to what we might have thought, dropping oil prices had no impact on the Canadian dollar, which posted gains against the greenback yesterday.

Uncertainty surrounding a potential key rate increase by the Fed appears to be weighing on the U.S. dollar, which is losing ground against most major currencies. On December 31, 2015, investors estimated at 93.3% the likelihood of at least one rate hike in 2016. It is now at 40.5%. This is the main reason for the 3.1% drop in the U.S. Dollar Index (DXY) since the beginning of the year.

Today, we are keeping an eye on the Import Price Index and Initial Jobless Claims data in the U.S. The Canadian dollar and oil prices are stable this morning.