Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Yet another stimulus plan for Japan

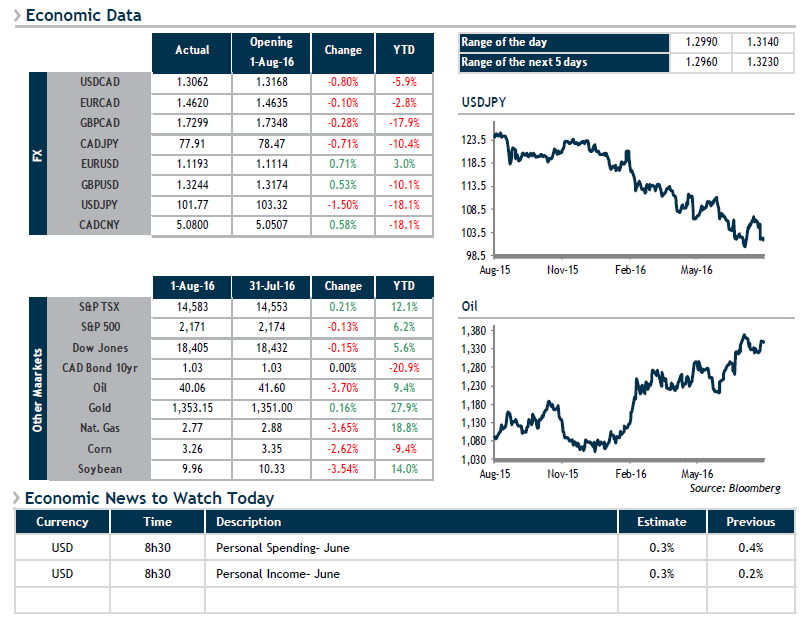

There was some action on the central bank front this morning as the Bank of Japan confirmed its plan of fiscal measures totalling 13.5 trillion yen and the Reserve Bank of Australia cut its key rate by 25 bps. In both cases, the news proved favourable for their respective currencies, particularly for the yen, which was the standout performer. As for the Australian dollar, one can only assume that the perspective that this is the last rate cut in the cards is providing support, as such a decision is normally not favourable for currencies.

Meanwhile, the loonie continues to dig in its heels and resist additional losses, despite crude oil slumping below the $40 a barrel threshold yesterday. Given the price at the pump this morning, it’s tough to make a case for the old chestnut about a “conspiracy” to keep gas prices high during the summer driving season.

This morning at 8:30, we’ll have a chance to get a better idea of how American consumers are faring with the release of Personal Consumption and Personal Income data. It should be noted that consumer activity represents 70% of U.S. GDP.