Our webinar

Stéfane Marion, our Economist and Chief Strategist, shared his post-Brexit analysis with us in our webinar on Thursday, July 14. If you have not had the chance to listen to it, click here.

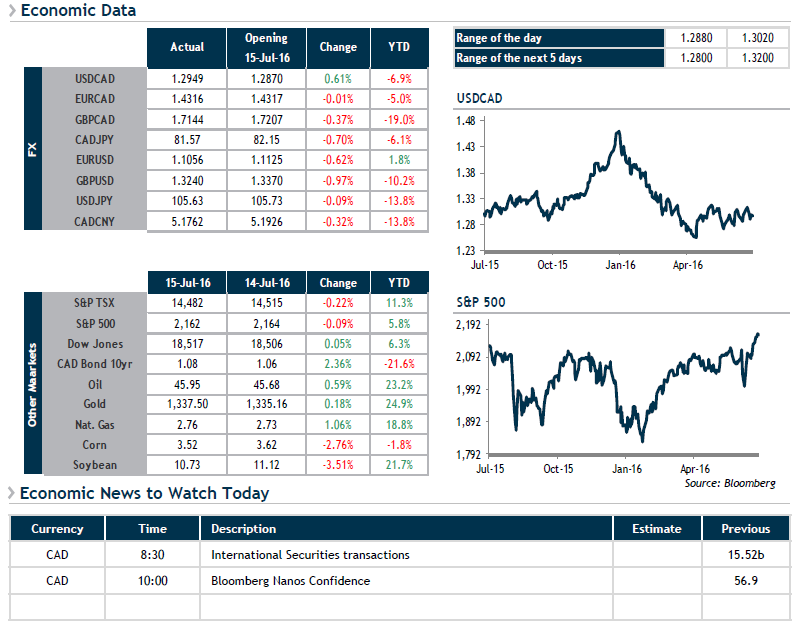

Main points of his comments on currencies: The surprise outcome of the Brexit referendum has wiped out any anticipations of rate increases in the United States, but this state of affairs could change very quickly and result in a surge in the USD/CAD pair toward 1.3500.

Already on Friday, good news south of the border (Retail Sales, etc.) slightly raised this likelihood, sending the USD higher.

The same effect was seen further to optimistic comments made by Federal Reserve members such as Dennis Lockhart, who told Reuters on Friday that the Fed could potentially foresee one or two rate hikes this year. However, he pointed out that the four rate hikes anticipated early in the year were no longer on the table.

Given this context, USD buyers could add hedging at current levels and sellers could place orders between 1.3000 and 1.3500.