Investing.com’s stocks of the week

Brexit shockwaves continue

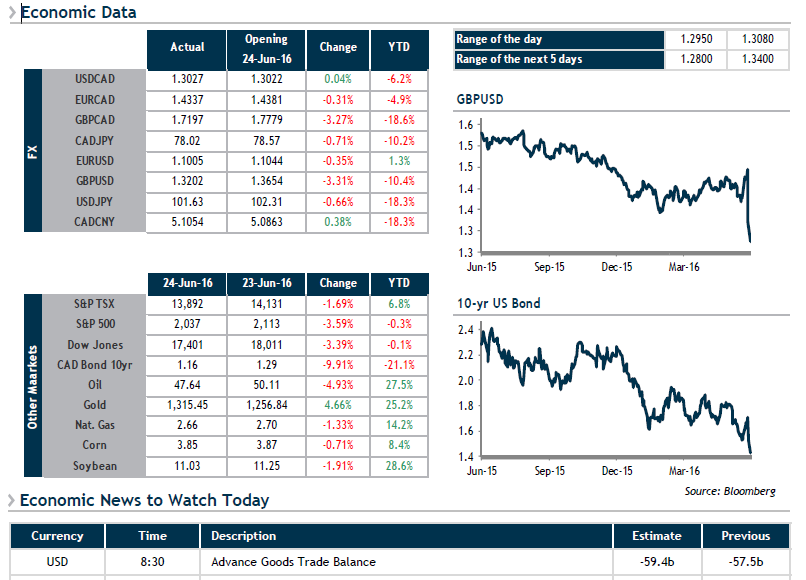

A shorter workweek is beginning in Canada and more significantly, the second session after “B” day. For the time being, the pound sterling remains the currency most affected, having lost nearly 12% against the greenback since Friday and trading at its lowest level in 30 years. Of course, after 43 years with Britain being part of the European Union, it is a page of British and world economic history that is being written, and it is weighing heavily on the markets. They are down again this morning, and it is estimated that over 2 trillion in global equity has vanished via the various indices since Friday. This does not appear to be over.

In this context, this Friday’s publication of U.S. employment data is less interesting. The United Kingdom has in a way enabled the Fed to maintain its credibility and postpone its interest rate hike, if need be. Thanks to its safe haven status, the greenback rose considerably, which for the U.S. economy, is the equivalent of monetary tightening. This morning, the probability of a rate increase south of the border is merely at 15% for December while a rate decrease from the Bank of England seems eminent. Overall, exercise caution and take advantage of this volatility to place orders.