Investing.com’s stocks of the week

Fed and Bank of Japan hold steady

Citing a possibly flagging job market, the U.S. Federal Reserve, as expected, opted to keep its key rate unchanged while leaving the door open to potential increases later this year. The Fed’s tone was more conservative on the growth expected from the U.S. economy in the medium term through 2017 and 2018, however. During her remarks after the decision, Chair Janet Yellen noted that Brexit had been taken into consideration and that further data confirming the economy’s momentum will be needed to continue normalizing monetary policy.

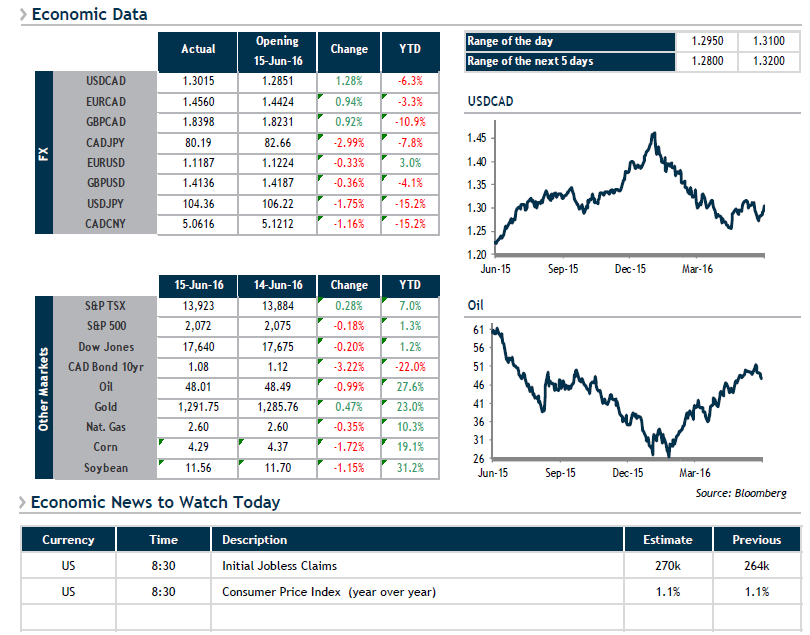

The Bank of Japan also decided against any changes to its monetary policy earlier this morning despite market expectations of increased stimulus measures. The yen is currently up 1.6% against the greenback. This morning, we’ll be keeping an eye on important inflation data south of the 49th parallel as measured by the May Consumer Price Index. It is likely that the CPI remained unchanged at 1.1%, well below the inflation target of 2%.

We see the Canadian dollar passing 1.3000 this morning. In the short term, it remains vulnerable to market uncertainty brought on by Brexit, the possibility of rate tightening south of the border and crude oil prices that are running out of steam.