Investing.com’s stocks of the week

Fed Day

Despite Brexit continuing to dominate headlines, the economic news published yesterday were encouraging for the U.S. economy. As confirmed by the 0.5% increase in retail sales, American consumers were active in May, thereby continuing the major gains posted in April. Signs of inflation are starting to appear with the price of imports up by 1.4% in April. These numbers are not enough to warrant a rate hike today but could motivate FOMC members to raise rates later on in the year.

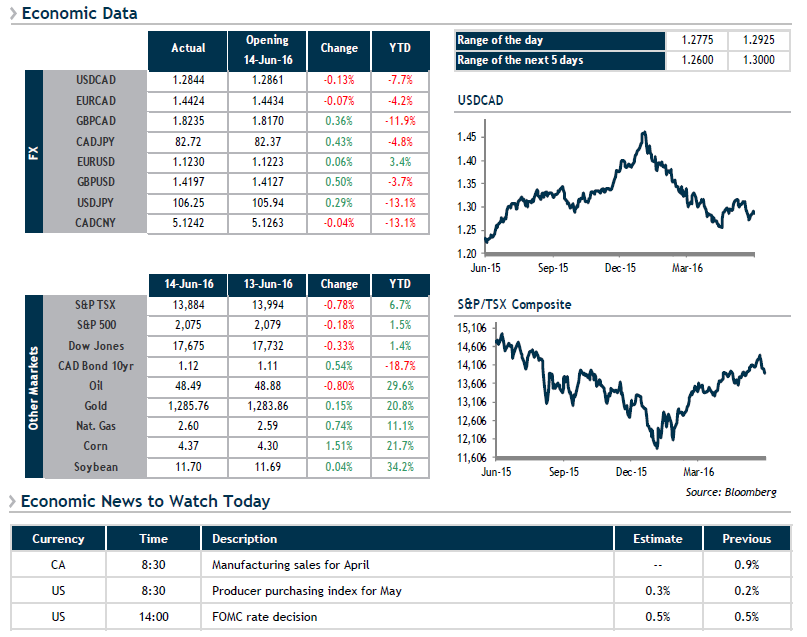

This morning, stock markets are in the green and the loonie is relatively unchanged in anticipation of the FOMC’s decision. The probability of a rate hike announcement at 2 p.m. today is estimated at 0%, but the press release that will follow will include updated economic forecasts. These figures and comments will be carefully scrutinized to assess the probability of increases for the remainder of 2016.