Investing.com’s stocks of the week

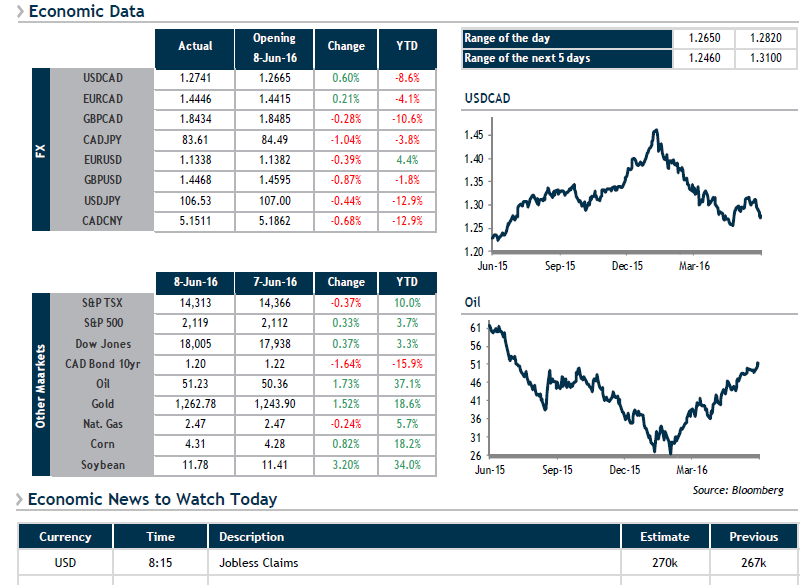

The continued march of crude oil above $51 kept the loonie strong throughout the trading day yesterday. We’ve gotten used to sharp movements in the USD/CAD pair over the past few months, but we are somewhat skeptical regarding this rise in the Canadian dollar of more than 500 points in just a few days.

Although we believe that the poor job reading south of the border has pushed back the interest rate hikes that everyone expected from the Fed for a few months, we have our doubts that the situation in Canada has improved that much that fast. As we near 1.2500, we continue to encourage USD buyers to think about hedging a portion of their exposure to the currency. The risk is now that the slightest hint of disappointing economic news on our side of the border will wipe out some or all of the 500-point rise in the CAD. Among the potential risks in the short term are Canadian employment figures to be announced on Friday. We also believe that the Bank of Canada must be looking at the surging loonie and thinking that exports would do better with a currency around 1.3000-1.3200.

Overnight, the Reserve Bank of New Zealand finally decided to hold off on cutting rates, while pointing out that it was prepared to do so in August if U.S. data continued to disappoint.