Even before Fed chair Janet Yellen’s eagerly awaited speech at lunchtime yesterday, the CAD had already climbed substantially against the USD. Ms. Yellen stated that the most recent U.S. job creation data were disappointing and struck a very nuanced tone in her remarks, which contained both optimistic and pessimistic elements including three key points:

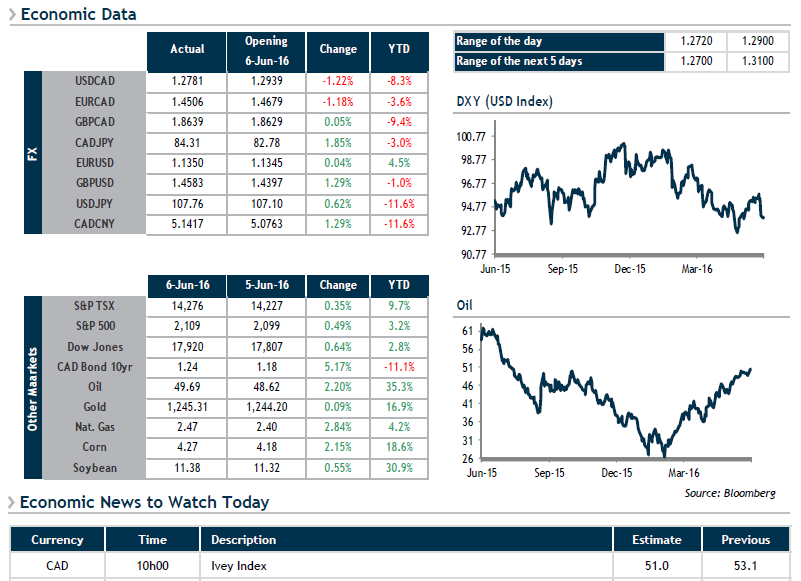

-Gradual interest rate hikes are still part of the Federal Reserve’s gameplan -The date for this monetary tightening is still uncertain and will depend on upcoming economic data -The risk surrounding the Brexit referendum in the United Kingdom is a persistent factor This led to an overall weaker greenback yesterday, albeit without any extreme movements. USD buyers may be interested in placing orders between 1.2500 and 1.3000. We would like to reiterate that our economists are projecting 1.2700 for Q2, 1.2500 for Q3 and 1.2800 for Q4 2016.

In the United Kingdom, the most recent surveys released yesterday morning on the Brexit question show the Leave camp ahead, placing the pound sterling at risk. Call your partners at the Bank to learn about hedging solutions if you have exposure to the GBP.