June rate hike off the table?

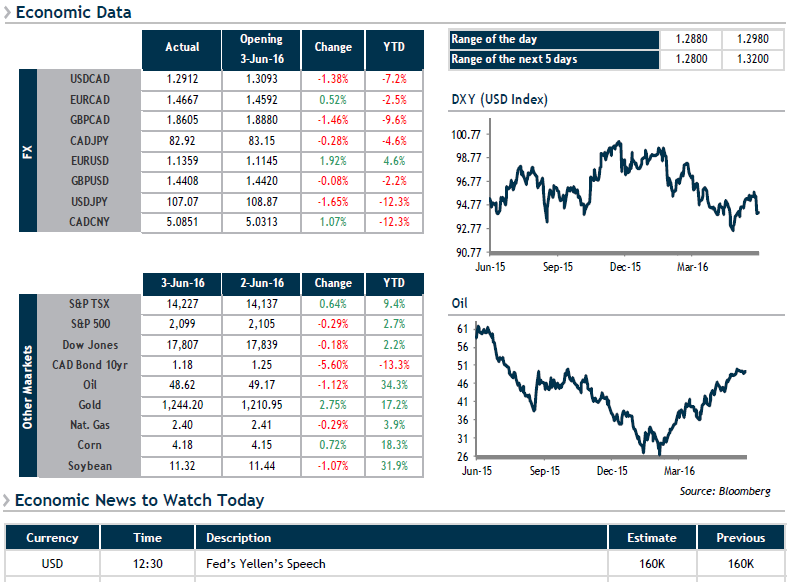

There was a major surprise on Friday morning when U.S. job figures showed only 38,000 positions created instead of the 165,000 expected, the worst showing since 2010. Federal Reserve members had spent the past month preparing markets for an interest rate hike in June or July. But with Friday’s news, the chances of monetary tightening have plunged from 30% to 4% in June and from 54% to 27% in July (federal funds futures). The U.S. dollar was also hard hit by the news, losing close to 200 points against the CAD.

This week, we’ll be keeping an eye on Canadian employment data on Friday. Slowing Q2 growth is expected to weigh on job creation. But more important is the speech that Fed chair Janet Yellen will give today at 12:30, which will be closely followed. She may clarify the Fed’s interpretation of Friday’s job numbers and whether they are considered a temporary lull or a longer term concern. Either way, the reaction in the USD should be fast.