Profit-taking in the energy market

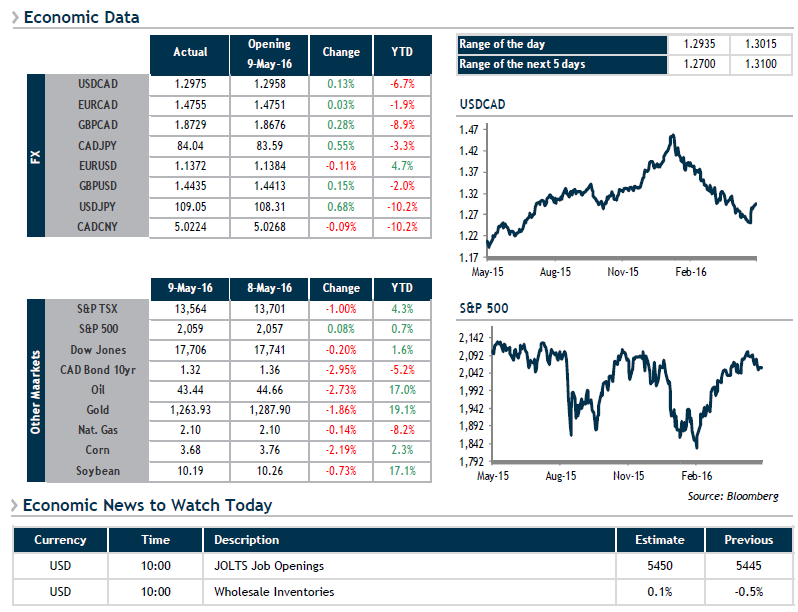

Yesterday was another eventful day for our team, as the loonie struggled against the greenback. The USD/CAD pair is now up 4.3% from its low point on May 2. It appears that the impact of forest fires in Fort McMurray on the country’s oil output will be limited and activities can be resumed quickly, which served as a pretext for profit-taking in the energy market.

The bearish trend in the USD/CAD now appears to be behind us, as investors’ attention shifts again to when the Fed will pull the trigger on its next key rate increase. This is good news for exporters, who are taking advantage of the current rally to lock in attractive rates for the months and quarters to come. The likelihood of at least one rate hike by the end of the year is currently 45%, down from 93% at the start of the year.

The economic calendar is sparse today and oil is stable this morning, while futures are pointing to an opening slightly in the green.