Greenback continues to rise!

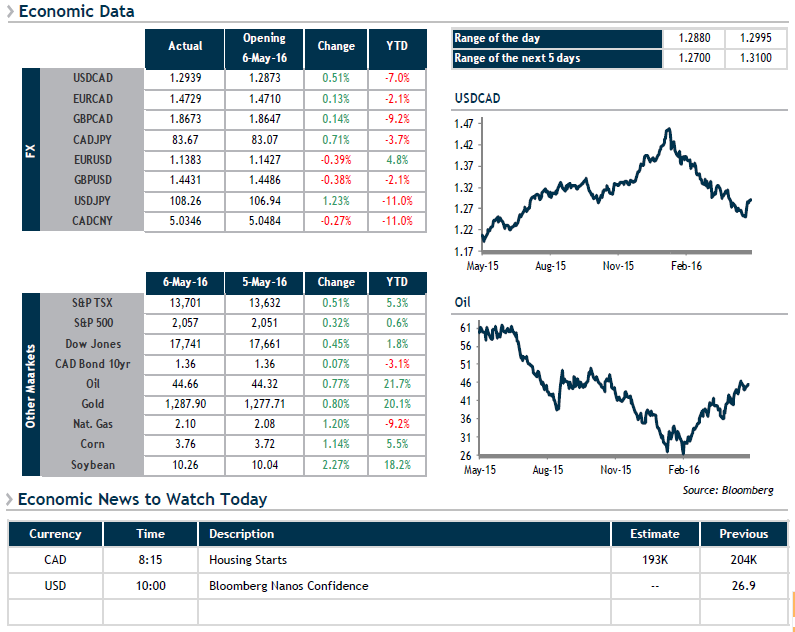

Despite disappointing job figures released on Friday, the U.S. dollar has just enjoyed its best week of the year, with gains against all its major rivals. In an interview with the New York Times, New York Fed President William Dudley stated that it was still reasonable to anticipate two rate hikes this year, which would bode very well for the USD.

Forest fires continue to rage around Fort McMurray, helping boost crude oil prices, which are up 3.8% over their close last Tuesday. With close to half of Canada’s oil sands output now affected by the fires, WTI is trading above $45 a barrel. The correlation between crude oil and the loonie appears to have dissipated, as the loonie is down 1.6% since markets closed on May 3.

Companies exporting to the United States are taking advantage of the situation to secure attractive exchange rates for the coming quarters. Given the recent volatility, a call to your trader may be a wise idea.