Focus on job data in Canada and the United States

Crude oil began to rise again Thursday, bringing stock markets along with it for a large part of the trading day, although the loonie mainly treaded water. The tragic wildfires in Fort McMurray have begun to have an impact on the price of oil, with many analysts estimating that oil sands output could be substantially affected. The disruption is estimated to be around 500,000 barrels a day and how long production will continue to be disrupted is very tough to estimate. This amount could increase if the pipeline network is affected, although such an occurrence is relatively unlikely given the underground system.

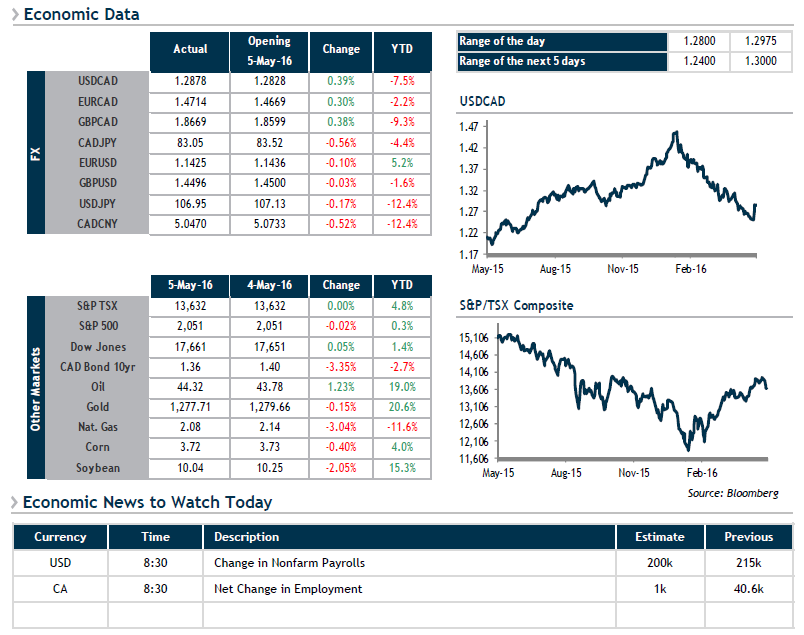

This morning, we’ll be keeping an eye on April job figures on both sides of the border, although expectations are not particularly high. In Canada, after impressive job creation in the first quarter, a slower pace is expected. Our economists expect a loss of 10,000 positions (consensus +1,000). South of the 49th parallel, job growth is expected to drop to 170,000 (consensus 200,000), in keeping with the slowdown seen recently in economic growth. A job reading above 225,000 could push the USD/CAD pair above 1.2950. We expect a bumpy ride on currency markets today.