Loonie loses steam

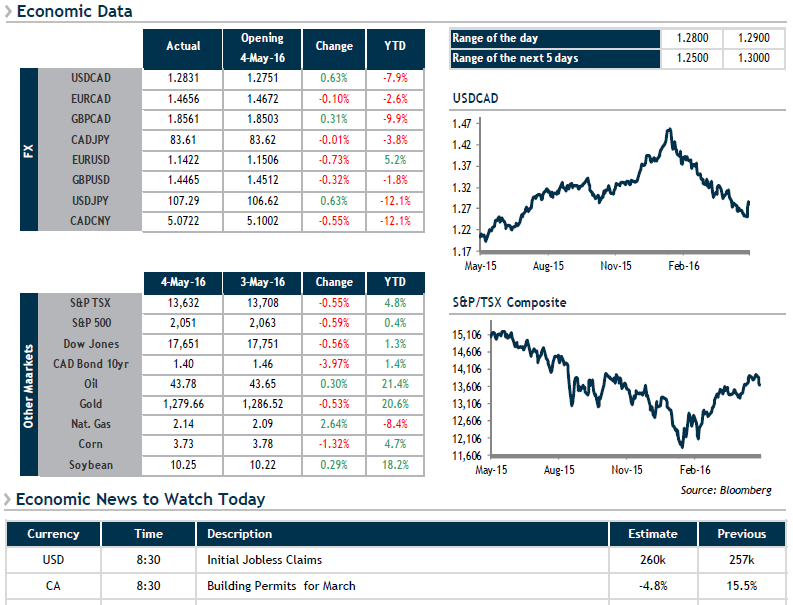

The sharp correction in the Canadian dollar stretched into its second day on Wednesday, with a loss of more than 1.1% vs. the greenback. The loonie has now fallen to third place among the strongest G10 currencies after the yen and the Norwegian krone with a gain of 7.6% for the year.

The Canadian economy is showing cracks, with a trade deficit of $3.4 billion, the largest on record. Exports fell 4.8% with all sectors except aerospace losing ground.

These lacklustre economic readings have swung the probabilities on where interest rates are headed in Canada. The likelihood of a key rate hike in 2016 has fallen to nil and markets are now pricing in a 20% chance of a rate cut this year. It should be noted that Australia decided on just such a course of action earlier this week, and many pundits are wondering whether the BoC will follow suit if the economic situation were to worsen.

Today, we’ll be keeping an eye on Initial Jobless Claims south of the border, which will give us a sneak peek at tomorrow’s job data. Everyone should now take note that 1.3000 is in our sights, but we expect a lull today.