Investing.com’s stocks of the week

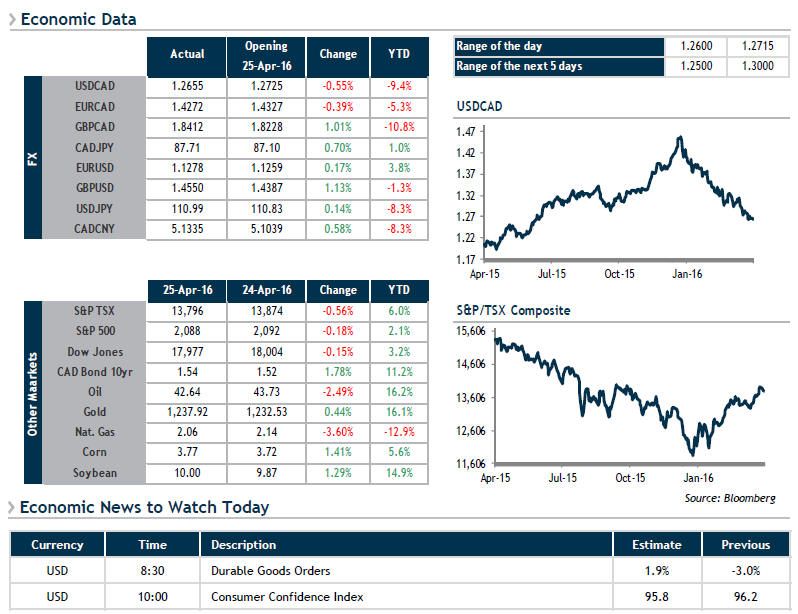

It was a rough ride for Canadian equities yesterday, which lost ground for a third straight day. Nevertheless, the TSX remains one of the top-performing stock exchanges since the start of the year, gaining more than 6%. Obviously, this performance is very much related to stabilizing crude oil prices, which have risen from U.S. $26 a barrel in February to more than U.S. $42 a barrel today. Despite these encouraging trends, many analysts are reiterating that prices remain historically low and Canada’s oil-producing provinces are still far from being out of the woods. In fact, the number of active rigs in Canada is apparently lower than it has been since 1984, underscoring that oil investment could continue to have a negative impact on Canadian growth.

Today, we’ll be keeping an eye on two major indicators south of the border: Durable Goods Orders and Consumer Confidence, which should whet investors’ appetite for the Fed’s key rate decision at 2 p.m. tomorrow and U.S Q1 GDP on Thursday.